Get The Latest News, Advice & Best Practice From Blog

How EIN helps in business identification for tax purposes

The Employer Identification Number (EIN) plays a crucial role in identifying a business for tax purposes in the United States. Here’s a detailed explanation:

Nov. 12, 2025, 5:39 p.m.

Read more

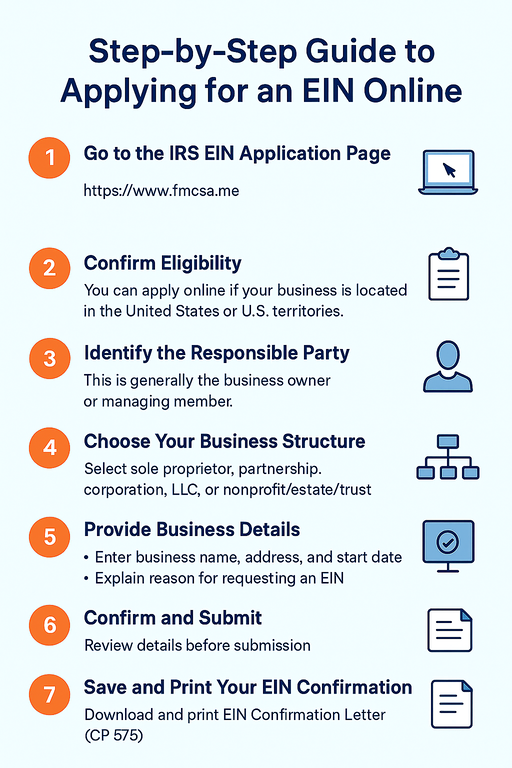

Step-by-Step Guide to Applying for an EIN Online

If you’re starting a business in the United States, one of the first tasks you’ll need to complete is getting an Employer Identification Number (EIN). Also known as a Federal Tax Identification Number, an EIN is issued by the Internal Revenue Service (IRS) and serves as a unique identifier for your business — much like a Social Security Number (SSN) does for individuals. Whether you’re forming an LLC, corporation, partnership, or nonprofit, applying for an EIN online is the fastest and easiest way to get your number.

Nov. 11, 2025, 6:25 p.m.

Read more

Can Individuals Apply for an EIN? (Freelancers & Sole Proprietors Explained)

If you’re a freelancer, independent contractor, or sole proprietor in the United States, you’ve probably heard about the Employer Identification Number (EIN). It’s a nine-digit number issued by the Internal Revenue Service (IRS) to identify a business for tax purposes — but many individuals aren’t sure whether they actually need one. Let’s break down who needs an EIN, why it might be beneficial, and how to apply.

Nov. 10, 2025, 3:31 p.m.

Read more

What Happens If You Lose Your EIN

If you lose or forget your EIN (Employer Identification Number), don’t worry — the IRS has clear steps to help you recover it. Here’s a full breakdown:

Nov. 9, 2025, 7:45 p.m.

Read more

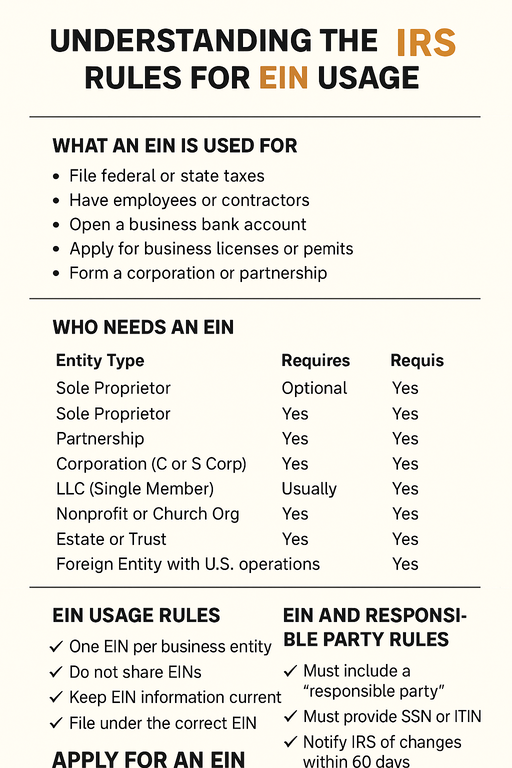

Understanding the IRS Rules for EIN Usage

An Employer Identification Number (EIN) is a unique nine-digit number issued by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. Think of it as your business’s Social Security number — it’s how the IRS tracks your company’s financial activity, tax filings, and compliance. Understanding the rules for EIN usage is essential for any U.S. business owner, whether you’re running a sole proprietorship, corporation, LLC, nonprofit, or partnership.

Nov. 8, 2025, 7:57 p.m.

Read more

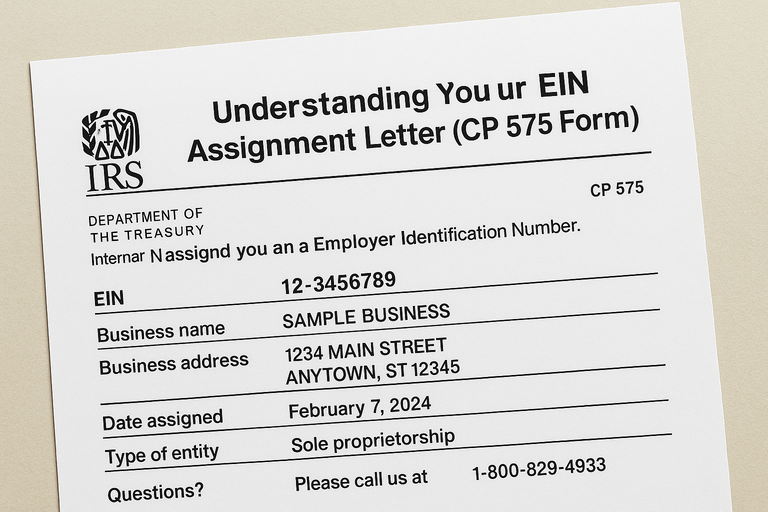

Understanding Your EIN Assignment Letter (CP 575 Form)

When you apply for an Employer Identification Number (EIN) with the IRS, you’ll receive a crucial document called the EIN Assignment Letter, officially known as Form CP 575. This letter is more than just a confirmation — it’s your business’s proof of identity for tax, banking, and legal purposes. In this guide, we’ll break down what the CP 575 letter is, what it contains, and why it’s so important to keep it safe.

Nov. 6, 2025, 8:26 p.m.

Read more

EIN and Business Licenses, What You Need to Know

Starting a business in the United States involves more than just a good idea — it requires meeting legal and tax requirements, including obtaining an Employer Identification Number (EIN) and the right business licenses. Though they both serve as forms of business identification, they are not the same thing and serve different purposes.

Nov. 5, 2025, 8:11 p.m.

Read more

EIN Requirements for Non-US Citizens and International Entrepreneurs

If you’re a non-U.S. citizen or international entrepreneur who wants to form or operate a business in the U.S., you’ll likely need an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Below is a breakdown of who needs one, how to apply when you don’t have an SSN/ITIN, and key tips & pitfalls to avoid. This is general information and not tax-or-legal advice, so you’ll want to consult a U.S. tax professional for your specific case.

Nov. 4, 2025, 7:16 p.m.

Read more

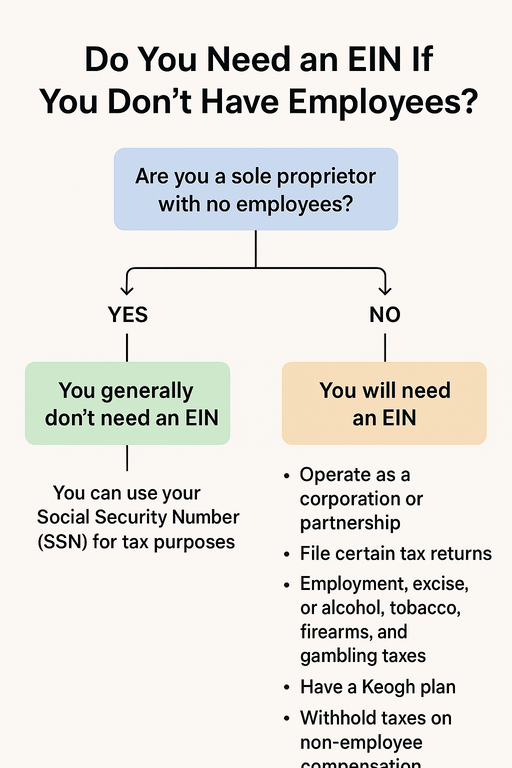

Do You Need an EIN If You Don’t Have Employees?

Many new business owners assume that an Employer Identification Number (EIN) is only required if they plan to hire employees — but that’s not always true. The IRS requires an EIN in several situations even if you have zero employees. Here’s a clear breakdown:

Nov. 3, 2025, 4:52 p.m.

Read more