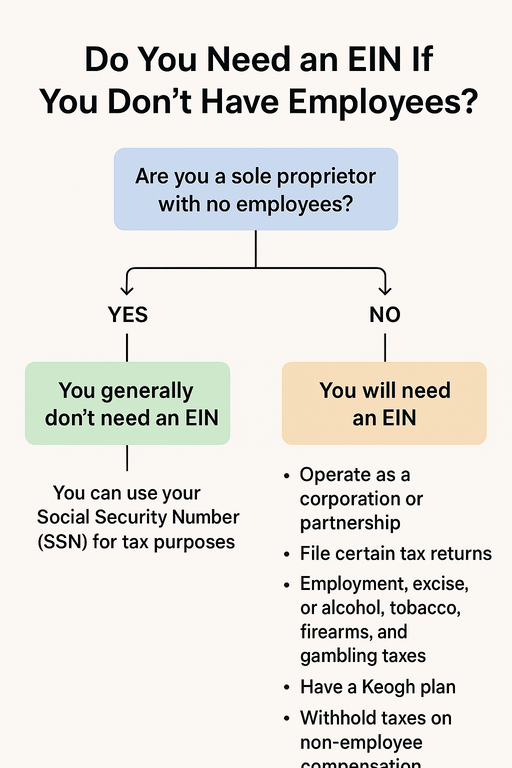

An EIN (Employer Identification Number) is a tax ID issued by the IRS for businesses. Even though it’s called an “Employer” ID, you don’t have to have employees to need one.

You DO NOT need an EIN if:

-

You are a sole proprietor with no employees, and

-

You don’t file special tax forms (like excise or pension plans)

In this case, you can use your Social Security Number (SSN) instead.

However, many sole proprietors still get an EIN to avoid sharing their SSN with vendors and clients.

You DO need an EIN if you are:

| Business Type | EIN Required Without Employees? |

|---|---|

| Single-member LLC | Only if taxed as corporation or have employees |

| Multi-member LLC | Yes – required |

| Corporation (S-Corp or C-Corp) | Yes – always required |

| Partnership | Yes – always required |

| Nonprofit, Trust, Estate | Yes – always required |

Why You Might Want an EIN Even If Not Required

-

Lets you open a business bank account

-

Protects your privacy (no SSN on forms)

-

Helps you look more professional

-

Needed later if you hire employees or restructure the business

How to Get One

Getting an EIN is free and only takes a few minutes online at the www.einregister.online

You can also apply by phone (502) 547-2551