Get The Latest News, Advice & Best Practice From Blog

Common EIN Application Mistakes to Avoid

Applying for an Employer Identification Number (EIN) is usually straightforward, but small errors can cause big delays, IRS rejections, or future tax problems. Whether you’re a new business owner, LLC, corporation, or foreign entity, avoiding these common EIN application mistakes will save time and frustration.

Feb. 5, 2026, 10:36 a.m.

Read more

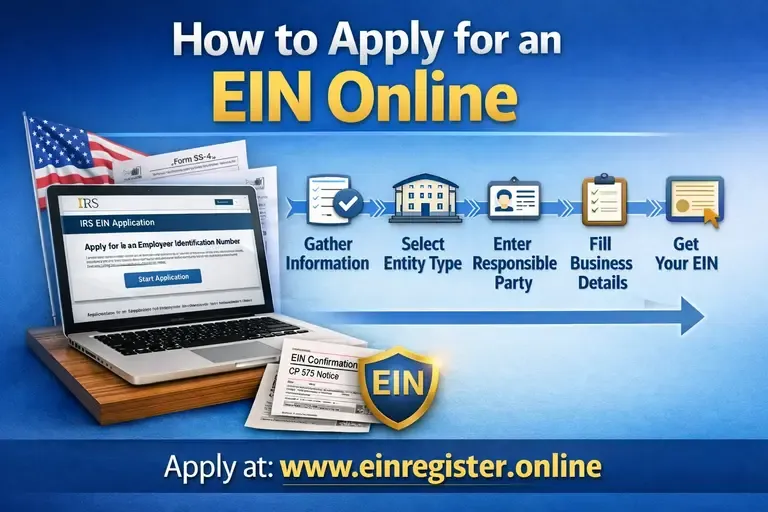

How to Apply for an EIN Online

How to apply for an EIN online in the United States through the www.einregister.online

Jan. 27, 2026, 9:06 p.m.

Read more

EIN for Opening a Merchant or Payment Processing Account

Opening a merchant account or payment processing account (Stripe, PayPal, Square, Authorize.net, etc.) in the U.S. almost always requires an EIN (Employer Identification Number)—especially if you’re operating as a business entity. Below is exactly why it’s required, when it’s optional, and how to get approved faster.

Jan. 25, 2026, 10:41 a.m.

Read more

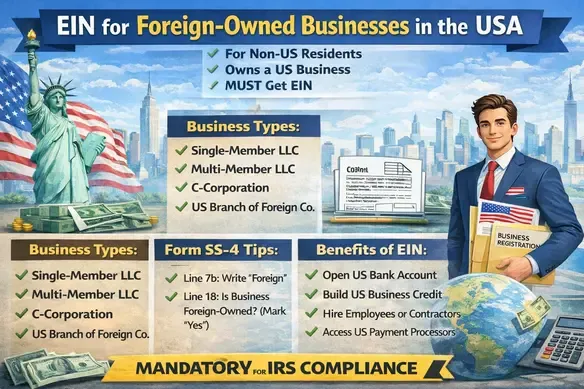

EIN for Foreign-Owned Businesses in the USA

Foreign entrepreneurs can legally own and operate businesses in the United States—even without being US residents. One of the first and most important steps is obtaining an Employer Identification Number (EIN) from the IRS.

Jan. 23, 2026, 7:52 p.m.

Read more

What is an EIN and Why It’s Important for Your Business

An Employer Identification Number (EIN), also called a Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business for tax purposes. It functions similarly to a Social Security Number (SSN) but for a business entity.

Jan. 21, 2026, 8:43 p.m.

Read more

EIN for Corporations-Everything You Should Know

An Employer Identification Number (EIN) is a federal tax ID issued by the IRS. For corporations in the United States, an EIN is not optional—it’s a legal requirement and a core part of doing business. Whether you’re forming a C Corporation or an S Corporation, here’s everything you need to know.

Jan. 19, 2026, 12:15 p.m.

Read more

When You Must Apply for a New EIN

An Employer Identification Number (EIN) is issued by the IRS to identify a business for tax purposes. While many business changes do not require a new EIN, certain structural or ownership changes do require you to apply for a new one.

Jan. 17, 2026, 6:04 p.m.

Read more

EIN Changes After Business Structure Updates

An Employer Identification Number (EIN) is issued by the IRS to identify a business for tax purposes. When a business changes its structure, the IRS rules determine whether you must apply for a new EIN or simply update your existing EIN information. Understanding this distinction is critical to avoid tax filing errors, penalties, or banking issues.

Jan. 15, 2026, 10:54 a.m.

Read more

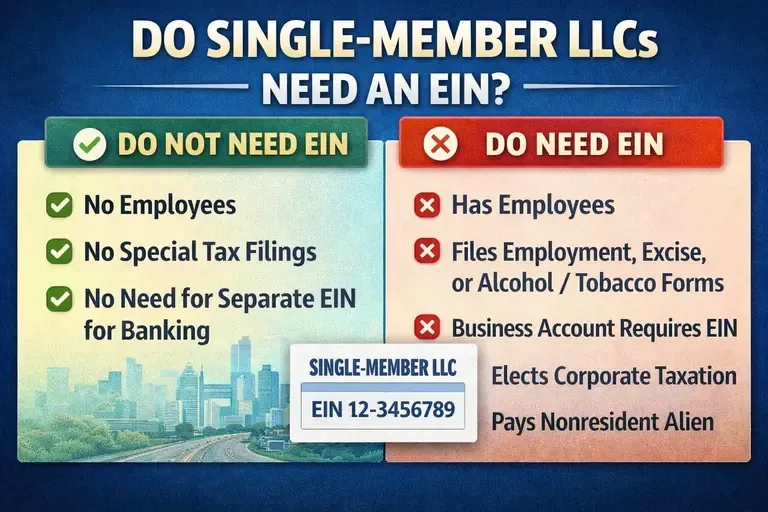

Do Single-Member LLCs Need an EIN?

A Single-Member LLC (SMLLC) is a limited liability company with one owner. By default, the IRS treats it as a disregarded entity for federal tax purposes — meaning the business income is reported on your personal tax return (Schedule C of Form 1040).

Jan. 13, 2026, 1:08 p.m.

Read more