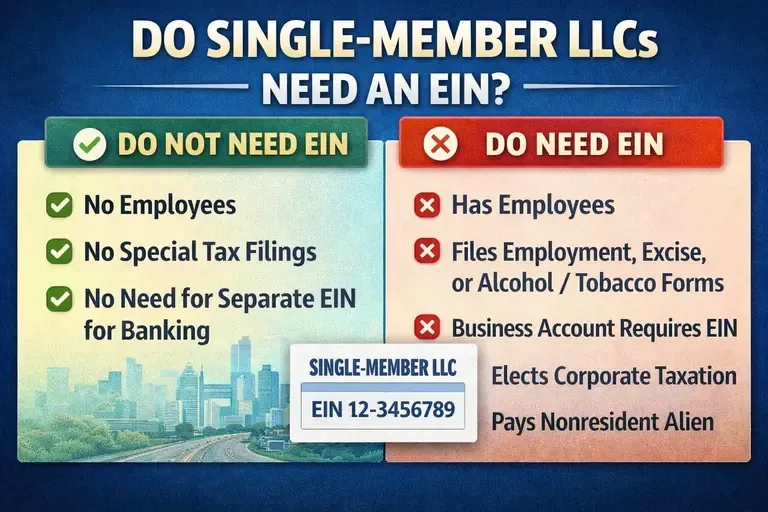

When a Single-Member LLC Does NOT Need an EIN

-

You have no employees.

-

You don’t file excise, alcohol, tobacco, firearms, or certain other special tax forms.

-

You don’t have a Keogh retirement plan or bank accounts that require an EIN.

In these cases, the owner’s Social Security Number (SSN) is sufficient for federal tax reporting.

When a Single-Member LLC DOES Need an EIN

You must get an EIN if your SMLLC:

-

Has employees (even just one).

-

Files certain federal tax forms, like employment taxes, excise taxes, or alcohol/tobacco/ firearms taxes.

-

Opens a business bank account that requires an EIN.

-

Elects to be taxed as a corporation (C-corp or S-corp).

-

Withholds taxes on income paid to a non-resident alien.

Getting an EIN usually takes minutes online at https://www.einregister.online/

Benefits of Getting an EIN for a Single-Member LLC

-

Separates personal and business finances

-

Required by many banks for opening business accounts

-

Protects your SSN from being used publicly

-

Required if you hire employees later

Bottom line:

-

If your SMLLC is just you, no employees, and no special filings, you can use your SSN instead of an EIN.

-

But if you want privacy, banking, or future flexibility, getting an EIN is recommended.