What Is an EIN?

An EIN (Employer Identification Number) is a unique 9-digit number issued by the IRS to identify a business for tax, banking, and compliance purposes. It works like a Social Security Number for a business.

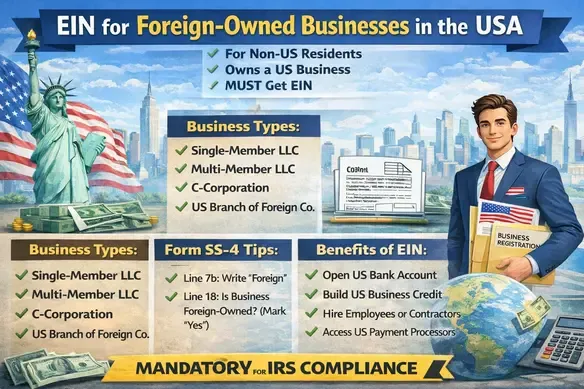

Do Foreign-Owned Businesses Need an EIN?

Yes. A foreign-owned business must obtain an EIN if it:

-

Is registered in the United States (LLC, Corporation, Partnership)

-

Opens a US business bank account

-

Files US federal tax returns

-

Has employees in the US

-

Is a single-member LLC owned by a non-US resident

-

Is required to file IRS Form 5472

Even if the business has no US employees, an EIN is still required in most cases.

Who Can Apply?

Foreign owners do NOT need:

-

A US Social Security Number (SSN)

-

An Individual Taxpayer Identification Number (ITIN)

-

US citizenship or residency

Non-US individuals and companies are fully eligible to apply.

How to Apply for an EIN as a Foreign Owner

Option 1: Apply Online

Option 2: Apply by Phone

-

(502) 547-2551

Common US Business Types for Foreign Owners

-

Single-Member LLC (most popular)

-

Multi-Member LLC

-

C-Corporation

-

US Branch of a Foreign Company

Each structure has different tax and reporting obligations.

Tax & Reporting Obligations

Foreign-owned US businesses may need to file:

-

Form 5472 (mandatory for foreign-owned single-member LLCs)

-

Federal income tax returns

-

State tax filings (depending on location)

Failure to file required forms can result in penalties up to $25,000.

Can You Open a US Bank Account with an EIN?

Yes. Most US banks require:

-

EIN confirmation letter (CP 575)

-

US business registration documents

-

Passport of the owner

-

Sometimes a US address

Some fintech banks may allow remote account opening.

Benefits of Having an EIN

-

Legal compliance with IRS rules

-

Ability to open US bank accounts

-

Hire employees or contractors

-

Build US business credibility

-

Access US payment processors (Stripe, Amazon, PayPal)

Final Thoughts

Getting an EIN is a mandatory and foundational step for foreign-owned businesses operating in the United States. While the process is straightforward, accuracy is critical to avoid delays or penalties.