Get The Latest News, Advice & Best Practice From Blog

EIN for trusts and estates

An Employer Identification Number (EIN) is a federal tax identification number issued by the IRS. For trusts and estates, an EIN is often required to properly report income, file tax returns, and manage financial accounts.

Dec. 17, 2025, 8:12 p.m.

Read more

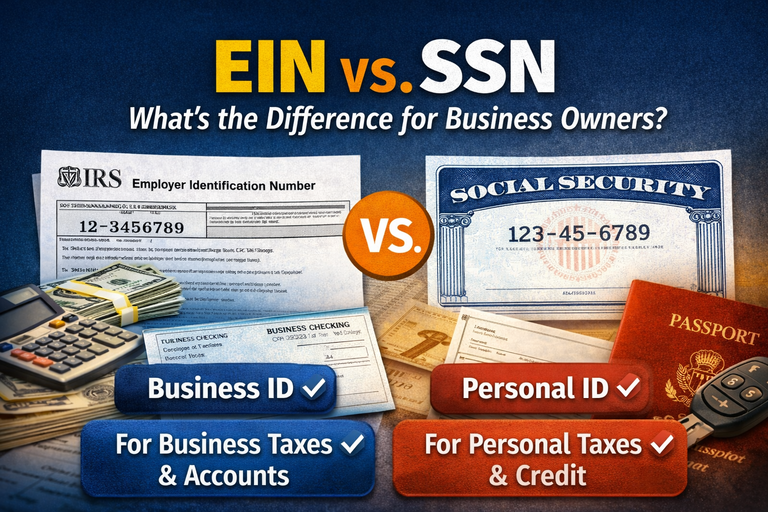

EIN vs SSN-What’s the Difference for Business Owners?

When starting or running a business in the United States, you’ll often be asked for either an EIN (Employer Identification Number) or an SSN (Social Security Number). While both are taxpayer identification numbers issued by the IRS, they serve very different purposes, especially for business owners.

Dec. 16, 2025, 4:19 p.m.

Read more

EIN for International Businesses Operating in the US

An Employer Identification Number (EIN) is a federal tax ID issued by the IRS. Foreign-owned and international businesses often need an EIN to legally operate, pay taxes, hire workers, and open U.S. bank accounts.

Dec. 15, 2025, 1 p.m.

Read more

How EINs Are Used by the IRS

An Employer Identification Number (EIN) is a unique nine-digit number issued by the IRS to identify a business or organization. Here’s how the IRS uses EINs in practice:

Dec. 13, 2025, 6:12 p.m.

Read more

Who Needs an EIN? (Individuals, businesses, and special cases)

An Employer Identification Number (EIN) — also called a Federal Tax ID — is issued by the IRS to identify a business entity for tax purposes. While not every person or business needs one, many do. Below is a complete breakdown of who is required to obtain an EIN.

Dec. 12, 2025, 6:29 p.m.

Read more

Changing business structure and EIN impact

When a business changes its legal structure, the IRS may require a new EIN. Whether you need one depends on how significant the change is. Below is a breakdown by scenario.

Dec. 11, 2025, 4:54 p.m.

Read more

EIN for Amazon, Shopify, and online sellers

An Employer Identification Number (EIN) is often needed by ecommerce sellers to verify their business identity, file taxes, and open financial accounts. While not always required, an EIN can make operating on Amazon, Shopify, Etsy, eBay, Walmart Marketplace, and other platforms much easier.

Dec. 10, 2025, 12:47 p.m.

Read more

Banking and Tax Benefits of Using an EIN

An Employer Identification Number (EIN) is more than just a tax ID used by the IRS. For businesses of all sizes—including LLCs, corporations, sole proprietors, Amazon sellers, and freelancers—having an EIN unlocks major advantages in banking, taxation, compliance, and overall business credibility. If you're starting a business or looking to operate more efficiently, here are the key banking and tax benefits of using an EIN.

Dec. 8, 2025, 7:10 p.m.

Read more

How EINs Relate to Federal Tax Classifications

An Employer Identification Number (EIN) is the unique federal tax ID the IRS uses to track a business. While an EIN identifies who the business is, the federal tax classification determines how the business is taxed. These two pieces work together — and understanding the relationship is essential for compliance, filing, and business structuring.

Dec. 7, 2025, 8:25 p.m.

Read more