Get the latest news, advice & best practice from blog.

SOME OF OUR NEWS FROM LATEST BLOG

Get the latest news, advice & best practice from blog.

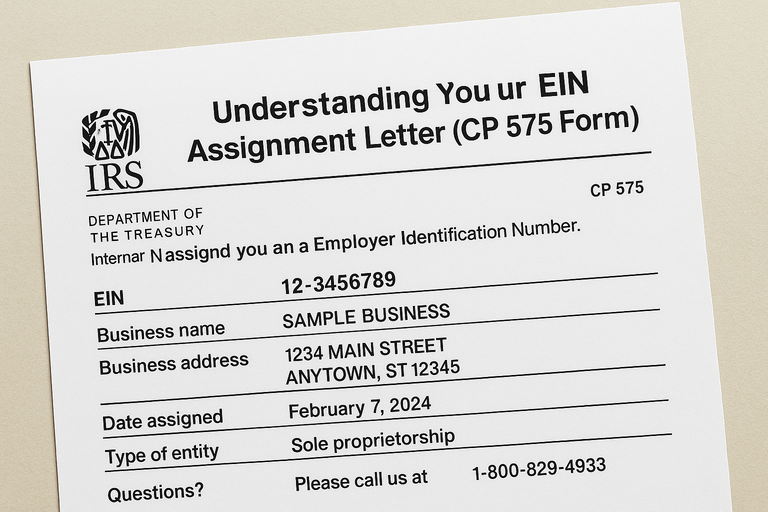

Understanding Your EIN Assignment Letter (CP 575 Form)

When you apply for an Employer Identification Number (EIN) with the IRS, you’ll receive a crucial document called the EIN Assignment Letter, officially known as Form CP 575. This letter is more than just a confirmation — it’s your business’s proof of identity for tax, banking, and legal purposes. In this guide, we’ll break down what the CP 575 letter is, what it contains, and why it’s so important to keep it safe.

Nov. 6, 2025, 8:26 p.m.

Read more

EIN and Business Licenses, What You Need to Know

Starting a business in the United States involves more than just a good idea — it requires meeting legal and tax requirements, including obtaining an Employer Identification Number (EIN) and the right business licenses. Though they both serve as forms of business identification, they are not the same thing and serve different purposes.

Nov. 5, 2025, 8:11 p.m.

Read more

EIN Requirements for Non-US Citizens and International Entrepreneurs

If you’re a non-U.S. citizen or international entrepreneur who wants to form or operate a business in the U.S., you’ll likely need an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Below is a breakdown of who needs one, how to apply when you don’t have an SSN/ITIN, and key tips & pitfalls to avoid. This is general information and not tax-or-legal advice, so you’ll want to consult a U.S. tax professional for your specific case.

Nov. 4, 2025, 7:16 p.m.

Read more

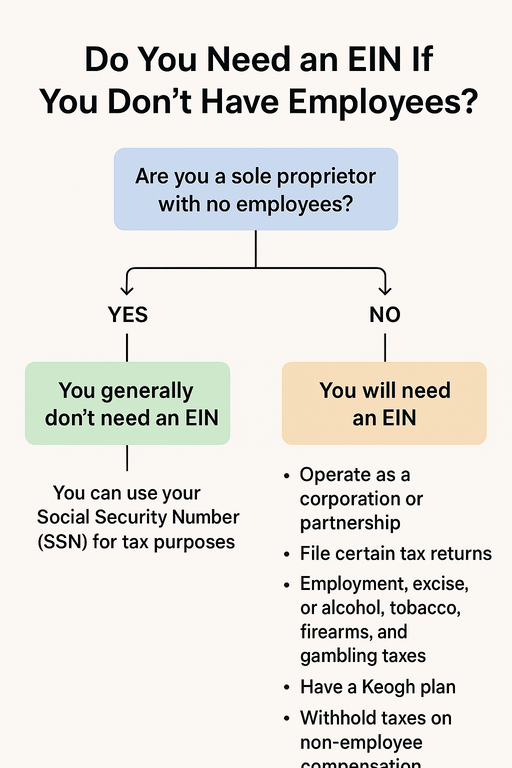

Do You Need an EIN If You Don’t Have Employees?

Many new business owners assume that an Employer Identification Number (EIN) is only required if they plan to hire employees — but that’s not always true. The IRS requires an EIN in several situations even if you have zero employees. Here’s a clear breakdown:

Nov. 3, 2025, 4:52 p.m.

Read more

How EINs Affect Business Banking and Credit Accounts

An Employer Identification Number (EIN) is more than just a tax ID—it’s a key part of how your business is recognized and trusted by financial institutions. Whether you’re opening a business bank account, applying for credit, or building a business credit profile, your EIN plays a central role.

Nov. 2, 2025, 5:36 p.m.

Read more

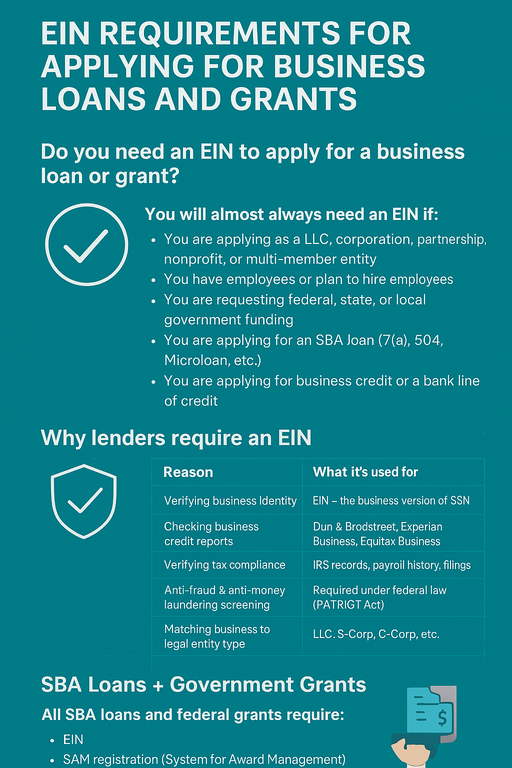

EIN requirements for applying for business loans and grants

Below is a detailed breakdown of EIN (Employer Identification Number) requirements when applying for business loans and grants in the United States, including banks, SBA loans, fintech lenders, and government-funded grants.

Nov. 1, 2025, 7:15 p.m.

Read more

Can You Transfer an EIN to Another Business?

When running or reorganizing a business, many owners wonder whether they can simply transfer their existing Employer Identification Number (EIN) to a new business entity. The short answer is no — in most cases, an EIN cannot be transferred from one business to another. Each EIN is assigned by the IRS to a specific legal entity and is meant to identify that entity alone. Let’s break down the details.

Oct. 31, 2025, 8:20 p.m.

Read more

How to Use an EIN When Hiring Employees

Hiring your first employee is a big milestone — and one that comes with new legal and tax responsibilities. One key requirement is having an Employer Identification Number (EIN). This unique nine-digit number, issued by the IRS, identifies your business for tax and employment reporting purposes. If you’re wondering how to properly use your EIN when hiring employees, this guide walks you through everything you need to know.

Oct. 30, 2025, 1:44 p.m.

Read more

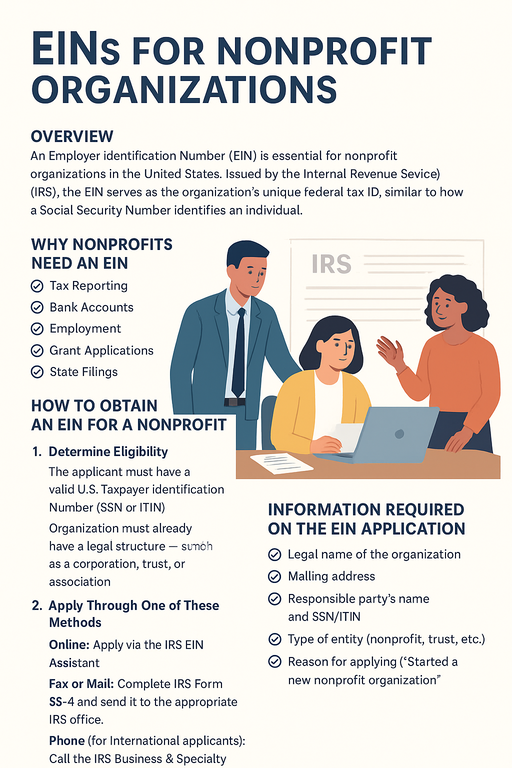

EINs for Nonprofit Organizations

An Employer Identification Number (EIN) is essential for nonprofit organizations in the United States. Issued by the Internal Revenue Service (IRS), the EIN serves as the organization’s unique federal tax ID, similar to how a Social Security Number identifies an individual. Even though many nonprofits are tax-exempt, they are still legally required to have an EIN to operate, hire employees, and comply with federal and state regulations.

Oct. 29, 2025, 5:21 p.m.

Read more