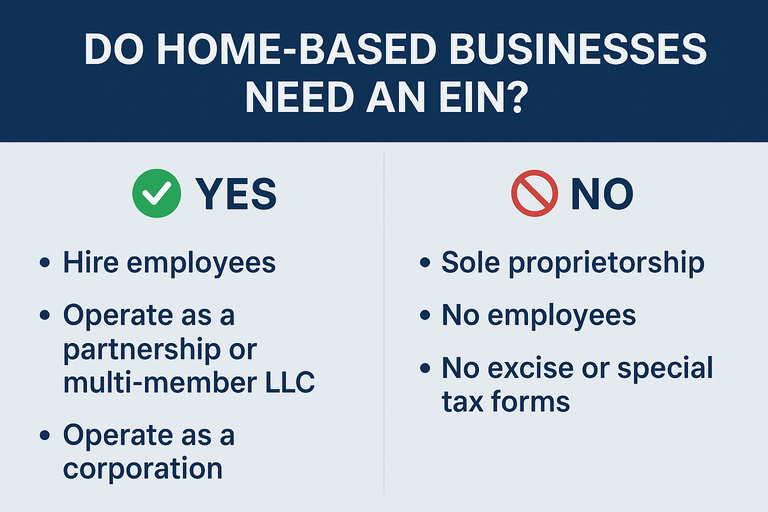

When a Home-Based Business Does Need an EIN

Your home-based business must get an EIN if any of the following apply:

1. You hire employees

Any business with employees is required to obtain an EIN for payroll tax reporting.

2. You operate as a partnership or multi-member LLC

Any business with more than one owner needs an EIN, even if operated from home.

3. You operate as a corporation (S-Corp or C-Corp)

All corporations must have an EIN.

4. You file specific federal tax returns

If your business must file excise tax returns, employment tax returns, or pension plan returns, you need an EIN.

5. You withhold taxes for nonresident aliens

For example, certain affiliate marketers or global contractors may fall into this category.

6. You run a home business involving certain regulated products

This includes alcohol, tobacco, firearms, diesel fuel, or anything requiring federal excise tax reporting.

When a Home-Based Business Does Not Need an EIN

You do NOT need an EIN if all of the following are true:

-

You are operating as a sole proprietor,

-

You have no employees, and

-

You do not file excise taxes or other special IRS forms.

Examples:

-

Home baker without employees

-

Freelance designer working alone

-

Etsy or eBay seller with no payroll

-

Online tutor or consultant

These businesses can use the owner's Social Security Number (SSN) for tax purposes.

Why Some Home-Based Sole Proprietors Still Choose an EIN

Even when not required, many home business owners get an EIN voluntarily because:

-

They don’t want to share their SSN with clients or vendors

-

It looks more professional when dealing with suppliers

-

Some banks require an EIN to open a business checking account

-

It can simplify bookkeeping and invoicing

It’s free and usually takes less than 5 minutes.

Quick Summary

| Home-Based Business Type | EIN Required? |

|---|---|

| Sole proprietor with no employees | No |

| Sole proprietor hiring employees | Yes |

| Partnership (any size) | Yes |

| Multi-member LLC | Yes |

| Single-member LLC (no employees) | Optional |

| S-Corp or C-Corp | Yes |

| Home-based business filing excise taxes | Yes |