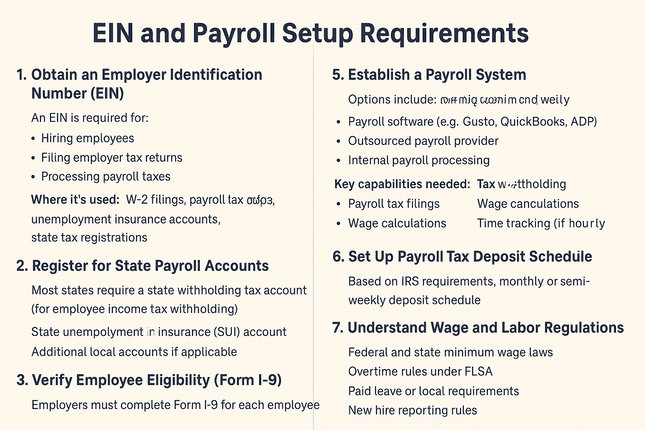

1. Why an EIN Is Required for Payroll

An Employer Identification Number is issued by the IRS and is required for:

-

Hiring employees

-

Reporting payroll taxes

-

Filing quarterly and annual tax returns

-

Issuing W-2s to employees

-

Opening payroll-related bank accounts

-

Withholding and depositing federal income tax

Without an EIN, payroll systems, banks, and tax agencies cannot process employee wage information.

2. Steps to Get an EIN

To begin payroll setup, a business must obtain an EIN from the IRS.

How to apply:

-

Online through the IRS EIN Assistant (fastest option)

-

By mail using Form SS-4

-

By fax

-

By phone (for foreign applicants only)

Once issued, the EIN is active immediately for payroll and tax purposes.

3. Federal Payroll Setup Requirements

Before running payroll, employers must complete several federal requirements:

A. Register for an EIN (IRS Form SS-4)

This identifies the employer in all payroll records.

B. Complete Form I-9 for EACH Employee

Used to verify identity and work authorization.

C. Collect Form W-4 From Employees

This determines how much federal income tax to withhold from their paychecks.

D. Submit New Hire Reports

Each newly hired worker must be reported to the state's New Hire Registry within 20 days (or sooner in some states).

4. State Payroll Setup Requirements

Depending on the state, employers may need to register for:

A. State Employer Payroll Tax ID

Used for reporting:

-

State income tax withholding

-

Unemployment insurance tax (SUTA)

B. State Disability Insurance (SDI) or Paid Leave Programs

Required in states such as:

-

CA

-

NY

-

NJ

-

WA

-

MA

-

CT

-

RI

Each state has its own deadlines and registration portals.

5. Payroll Tax Deposit Requirements

Employers must deposit federal payroll taxes, which include:

-

Federal income tax withholding

-

Social Security taxes

-

Medicare taxes

Deposits are made electronically using the EFTPS (Electronic Federal Tax Payment System).

Deposit schedules may be:

-

Monthly

-

Semiweekly

-

Next-day deposit (for large liabilities)

Schedules depend on the employer's lookback period and total payroll tax liability.

6. Required Federal Payroll Tax Forms

Employers must file several recurring forms:

Quarterly:

-

Form 941 – Employer’s Quarterly Federal Tax Return

Annually:

-

Form W-2 – Wage and Tax Statement for each employee

-

Form W-3 – Transmittal summary of W-2s

-

Form 940 – Annual Federal Unemployment Tax (FUTA) Return

Missing any of these filings can result in penalties.

7. Payroll Records Employers Must Keep

Employers must maintain payroll records for at least 4 years, including:

-

EIN and business tax records

-

Employee personal data

-

Hours worked

-

Wage rates

-

Tax withholding information

-

Payroll tax filing receipts

-

Benefit deductions

Records may be stored digitally or physically but must be accessible for audits or employee requests.

8. Penalties for Incorrect EIN or Payroll Setup

Common mistakes and their consequences:

-

Using an incorrect EIN → Filing rejections, IRS penalties

-

Failing to register for state payroll accounts → State fines

-

Late payroll tax deposits → Interest + penalties

-

Incorrect W-2s → IRS corrections and penalties

-

Missing quarterly forms → IRS enforcement actions

Proper setup prevents costly compliance issues.

Summary

Setting up payroll in the U.S. requires:

-

Obtaining an EIN

-

Completing employee forms (I-9, W-4)

-

Registering for state payroll accounts

-

Using EFTPS for federal tax deposits

-

Filing required quarterly and annual reporting

-

Maintaining compliant payroll records

An EIN is the foundation of payroll compliance—every other payroll requirement depends on it.