Get the latest news, advice & best practice from blog.

SOME OF OUR NEWS FROM LATEST BLOG

Get the latest news, advice & best practice from blog.

How EINs help track business taxes and compliance with the IRS

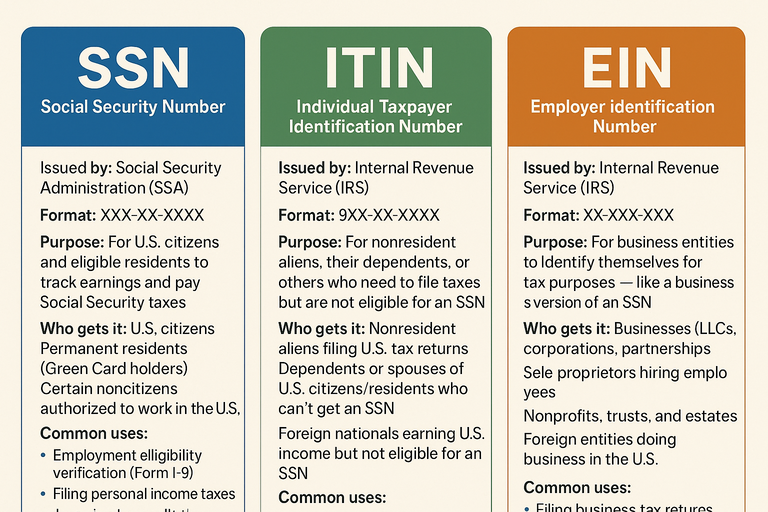

In the United States, every legitimate business needs a unique way to identify itself for tax and regulatory purposes. That’s where the Employer Identification Number (EIN) comes in. Often called a “business Social Security Number,” an EIN is essential for tracking tax obligations, filing returns, and maintaining compliance with federal laws.

Oct. 28, 2025, 1:31 p.m.

Read more

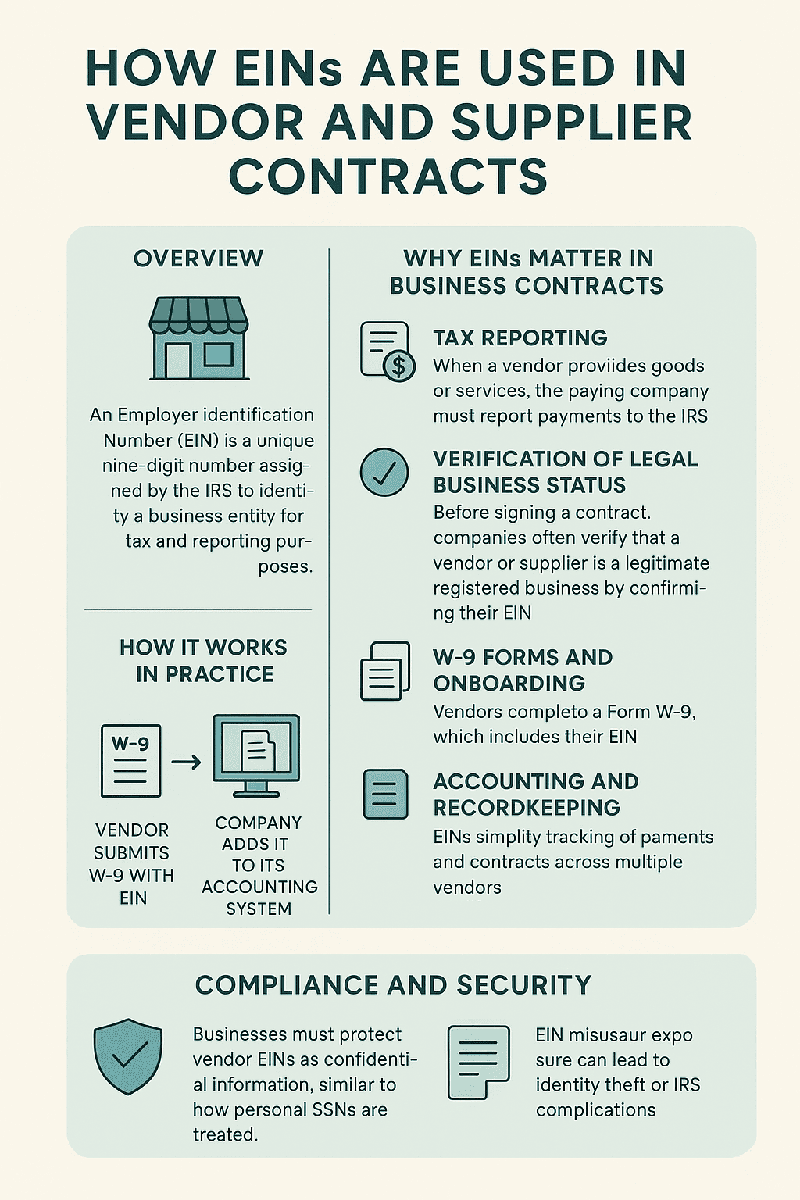

How EINs Are Used in Vendor and Supplier Contracts

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the IRS to identify a business entity for tax and reporting purposes. In vendor and supplier relationships, an EIN functions like a “business ID number,” ensuring legal compliance, tax tracking, and transparent financial documentation between companies.

Oct. 27, 2025, 1:19 p.m.

Read more

Can You Have More Than One EIN?

When running multiple businesses or making changes to your business structure, you might wonder — can you have more than one Employer Identification Number (EIN)? The short answer is: it depends on your business situation. Let’s break it down.

Oct. 26, 2025, 4:08 p.m.

Read more

Common Reasons Why Your EIN Application Gets Rejected

Applying for an Employer Identification Number (EIN) with the IRS is usually a quick and simple process — but sometimes, applications get delayed or even rejected. Understanding the most common reasons can help you avoid frustration and get your EIN successfully issued the first time.

Oct. 25, 2025, 4:12 p.m.

Read more

Common Myths and Misconceptions About EINs

The Employer Identification Number (EIN) — sometimes called a Federal Tax ID — is essential for many U.S. businesses. Yet, many entrepreneurs, freelancers, and even small business owners misunderstand what an EIN really is and how it should be used. Let’s clear up some of the most common myths and misconceptions about EINs.

Oct. 24, 2025, 5:59 a.m.

Read more

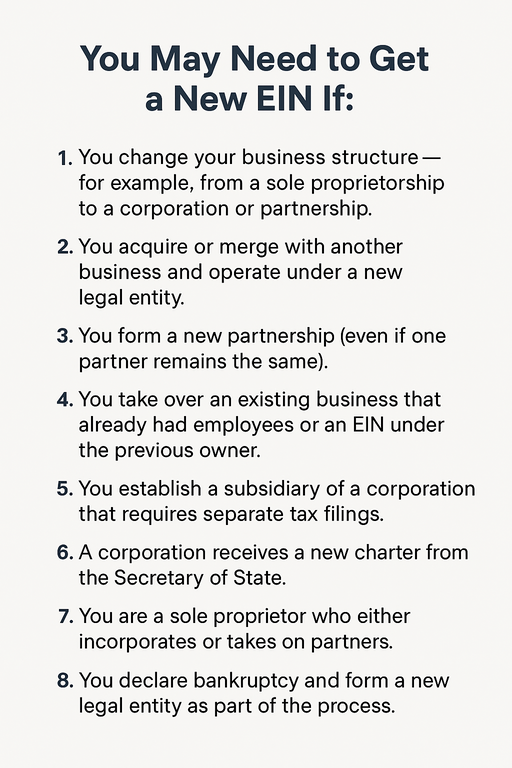

You may need to get a new EIN if:

Good question — let’s go into detail on when you need to get a new EIN (Employer Identification Number) according to IRS rules.

Oct. 23, 2025, 6:41 p.m.

Read more

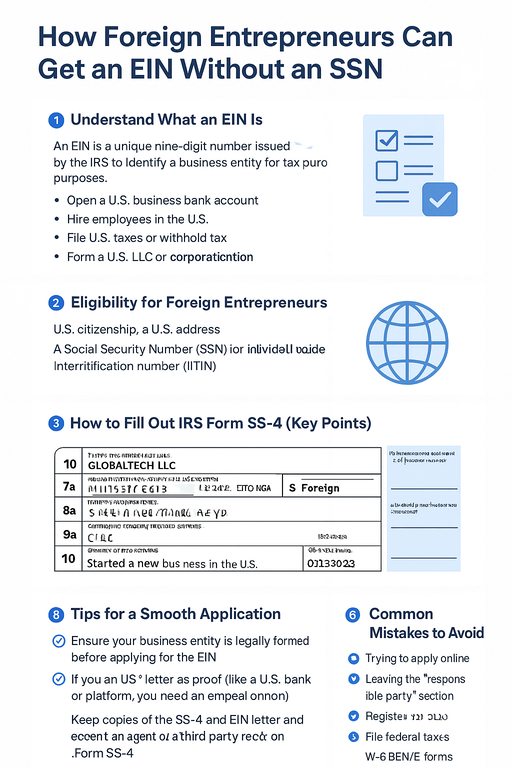

How Foreign Entrepreneurs Can Get an EIN Without an SSN

Here’s a detailed guide on how foreign entrepreneurs can obtain an Employer Identification Number (EIN) in the U.S. without having a Social Security Number (SSN) — ideal for non-U.S. residents who own U.S. companies or plan to form them.

Oct. 21, 2025, 6:25 a.m.

Read more

EIN for LLCs (single-member vs multi-member)

Let’s dive into EIN for LLCs, focusing on the differences between single-member and multi-member LLCs.

Oct. 20, 2025, 6:39 a.m.

Read more