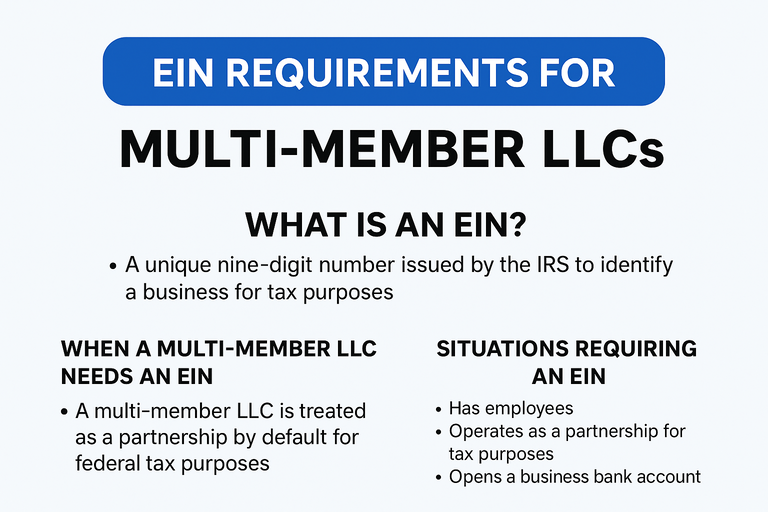

1. What is an EIN?

An EIN is a unique nine-digit number assigned by the IRS to identify a business for tax purposes. It functions similarly to a Social Security Number but for a business entity.

2. When a multi-member LLC needs an EIN

A multi-member LLC is treated as a partnership for federal tax purposes unless it elects to be taxed as a corporation. You generally must get an EIN if:

-

The LLC has more than one member (which is always the case for multi-member LLCs).

-

The LLC files any federal tax return, such as:

-

Form 1065 (U.S. Return of Partnership Income)

-

Employment tax returns (if it has employees)

-

Excise tax returns

-

-

The LLC has employees, even if not filing a partnership return.

-

The LLC withholds taxes on income, other than wages, paid to a non-resident alien.

-

The LLC operates as a corporation for tax purposes, if it elects C-corp or S-corp status.

In short: Almost all multi-member LLCs need an EIN.

3. Exceptions

A multi-member LLC may not need an EIN if:

-

It has no employees,

-

It is not required to file any excise or pension plan tax returns,

-

Its only income is from a single member’s personal tax reporting—but this scenario is extremely rare for multi-member LLCs.

4. How to get an EIN

You can obtain an EIN:

-

Online: www.einregister.online

-

By phone: (502) 547-2551

5. Important notes for multi-member LLCs

-

Operating Agreement: Even though not required for EIN application, it’s essential for clarifying members’ roles.

-

Single vs Multi-Member: A single-member LLC can use the owner’s SSN in some cases; a multi-member LLC cannot—EIN is required.

-

Tax classification flexibility: A multi-member LLC can elect corporate taxation (Form 8832) or S-corp status (Form 2553), but the EIN is still mandatory.