What Is an EIN?

An EIN is a 9-digit number issued by the IRS to identify a business entity for tax and reporting purposes.

Common uses of an EIN include:

-

Filing business tax returns

-

Hiring and paying employees

-

Opening a business bank account

-

Applying for business licenses and permits

-

Filing payroll and excise taxes

-

Establishing business credit

Who typically needs an EIN?

-

LLCs and corporations

-

Partnerships

-

Businesses with employees

-

Nonprofits and trusts

-

Sole proprietors who want separation from their SSN

What Is an SSN?

An SSN is a 9-digit number issued to individuals by the Social Security Administration.

Common uses of an SSN include:

-

Personal income tax filing

-

Employment verification

-

Social Security benefits

-

Personal credit reporting

For sole proprietors without employees, an SSN can sometimes be used instead of an EIN—but this is not always ideal.

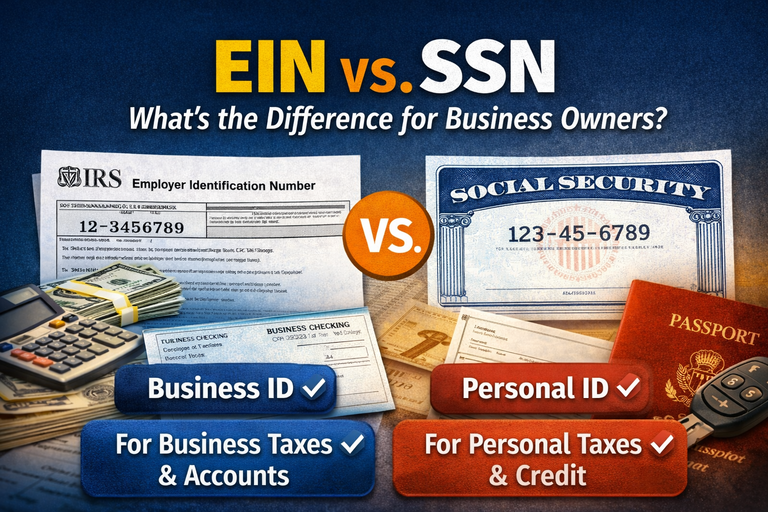

EIN vs. SSN: Key Differences at a Glance

| Feature | EIN | SSN |

|---|---|---|

| Issued to | Businesses | Individuals |

| Issuing agency | IRS | Social Security Administration |

| Primary use | Business tax & reporting | Personal identification & taxes |

| Used for payroll | Yes | No |

| Helps separate business & personal finances | Yes | No |

| Risk if exposed | Lower personal risk | High identity theft risk |

Which One Should Business Owners Use?

Sole Proprietors

-

May use an SSN if they have no employees

-

EIN is recommended to protect personal identity and appear more professional

LLCs & Corporations

-

EIN is required

-

SSNs cannot be used for entity tax filing

Businesses With Employees

-

EIN is mandatory

-

SSNs are not allowed for payroll tax filings

Can You Have Both an EIN and an SSN?

Yes. Many business owners have both:

-

An SSN for personal income and individual tax matters

-

An EIN for business operations and filings

The IRS uses them differently, and having both is completely normal.

EIN vs. SSN for Banking and Licenses

Most banks and state agencies require an EIN to:

-

Open a business bank account

-

Apply for business loans

-

Obtain business permits

Using an SSN instead can limit your business’s growth and expose personal information.

Security and Privacy Considerations

Using an EIN instead of an SSN:

-

Reduces risk of identity theft

-

Keeps personal and business finances separate

-

Looks more professional to banks, vendors, and clients

Final Thoughts

While both numbers are important, business owners should rely on an EIN whenever possible. An SSN is designed for personal use, while an EIN is built specifically for business compliance, tax filing, and growth.

https://www.irs.gov/businesses/small-businesses-self-employed