An Employer Identification Number (EIN) is a nine-digit number issued by the IRS to identify your business for tax purposes.

It’s required for:

-

Filing federal and state taxes

-

Hiring employees

-

Opening a business bank account

-

Applying for business licenses and permits

Important: EINs are free from the IRS. You do not need to pay a third-party website. (irs.gov)

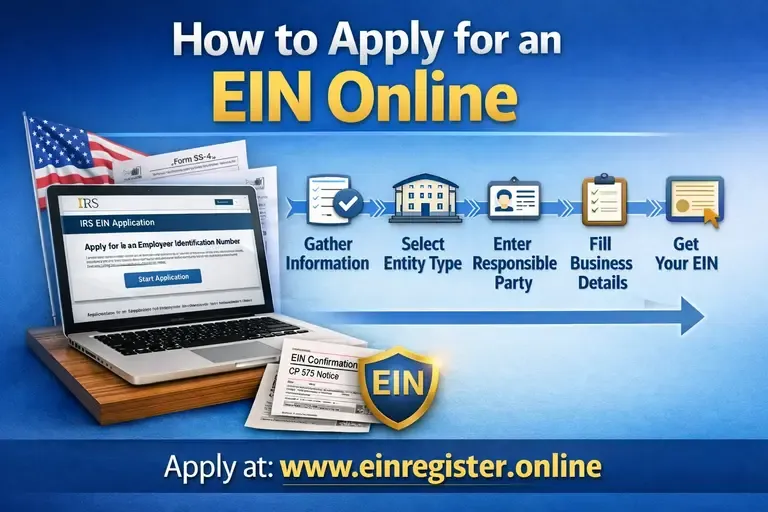

Step-by-Step Guide to Apply for an EIN Online

1. Go to the IRS EIN Application at https://www.einregister.online/

Apply for an EIN Online

Tip: Bookmark this page to avoid delays.

2. Prepare the Required Information

Before you start, gather the following:

-

Legal business name

-

Business mailing address

-

Business type/entity (LLC, corporation, partnership, sole proprietorship, nonprofit, etc.)

-

Responsible party’s SSN or ITIN

-

Reason for applying (starting a business, hiring employees, banking, etc.)

3. Start the Online Application

-

Click “Apply Online Now”.

-

The system will guide you through a series of questions about your business.

-

Make sure you complete the application in one session, as it expires after ~15 minutes of inactivity.

4. Submit the Application

-

Review all your information carefully.

-

Click Submit when complete.

Upon approval, your EIN is issued immediately

5. Download and Save Your EIN Confirmation

-

Download the CP-575 notice (official EIN confirmation letter).

-

Print a copy for your records — you’ll need it for:

-

Opening business bank accounts

-

Filing federal and state taxes

-

Obtaining licenses or permits

-

6. Important Notes

-

U.S. Location Requirement: Your business must have a primary location in the U.S. or U.S. territories.

-

One EIN per Responsible Party per Day: The IRS limits applications to one per responsible party per day.

Alternative Methods (If Online Is Not Possible)

If you cannot apply online:

-

Phone: (502) 547-2551

Summary

To apply for an EIN online:

-

Visit the IRS l EIN application at https://www.einregister.online/ .

-

Gather business info and responsible party details.

-

Complete the online form in one session.

-

Submit and receive your EIN immediately.

-

Download and save your official EIN confirmation letter.