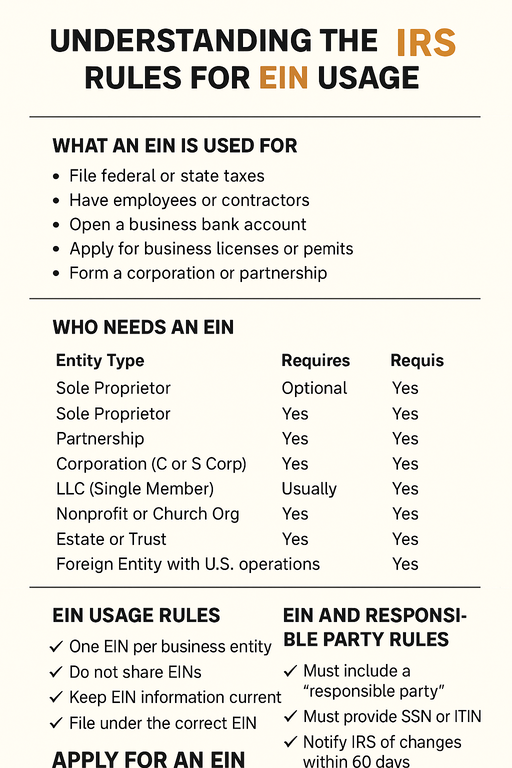

1. What an EIN Is Used For

The IRS requires an EIN for several key business activities. You’ll need one if you:

-

File federal or state taxes for your business

-

Have employees or contractors on payroll

-

Open a business bank account

-

Apply for business licenses or permits

-

Form a corporation or partnership

-

Withhold taxes on income paid to a nonresident alien

-

File excise, employment, or alcohol/tobacco/firearms taxes

-

Operate certain types of trusts, estates, or nonprofits

Essentially, your EIN serves as the official identifier for your business in the federal tax system.

2. Who Needs an EIN (According to the IRS)

The IRS mandates that an EIN be obtained by entities that fall into the following categories:

| Entity Type | EIN Required? | Notes |

|---|---|---|

| Sole Proprietor (no employees) | Optional | Can use SSN unless hiring or forming an LLC. |

| Sole Proprietor (with employees) | Yes | Required for payroll and employment taxes. |

| Partnership | Yes | Mandatory for filing Form 1065 and issuing K-1s. |

| Corporation (C or S Corp) | Yes | Required for tax filings and payroll. |

| LLC (Single Member) | Usually | Required if hiring employees or electing S-Corp taxation. |

| Nonprofit or Church Organization | Yes | Required for federal tax exemption filings. |

| Estate or Trust | Yes | Used for estate income and fiduciary returns. |

| Foreign Entity with U.S. operations | Yes | Must have an EIN for U.S. tax compliance. |

3. When You Need to Apply for a New EIN

Not every business change requires a new EIN — but certain structural or ownership changes do.

You must apply for a new EIN if:

-

You incorporate your business or form a new LLC.

-

You change ownership or merge with another business.

-

Your business structure changes (e.g., sole proprietorship → corporation).

-

You take over an existing business you didn’t own before.

-

You file bankruptcy under a new legal entity.

You do not need a new EIN if:

-

You only change your business name or address.

-

You add or remove members in an existing LLC (unless ownership changes significantly).

-

You open a new business location.

4. EIN Usage Rules and Restrictions

Once issued, your EIN is permanent. The IRS expects it to be used correctly and consistently.

Here are key IRS usage rules:

-

One EIN per business entity. Do not use one EIN for multiple, separate companies.

-

Do not share EINs. Even within a group of related businesses, each legal entity must have its own EIN.

-

Keep EIN information current. Notify the IRS if your business name, address, or responsible party changes (Form 8822-B).

-

File under the correct EIN. Mixing up EINs on tax returns or payroll reports can trigger IRS compliance issues.

-

Deactivate unused EINs. If you close your business, send a letter to the IRS to close your EIN account.

5. EIN and Responsible Party Rules

The IRS requires that each EIN application include a “responsible party” — the individual who owns or controls the business.

-

For most small businesses, this is the owner, partner, or managing member.

-

The responsible party must provide a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

-

The IRS must be notified within 60 days of any change in the responsible party (using Form 8822-B).

6. EIN and Tax Compliance

Your EIN links directly to your business tax obligations. It’s required for filing:

-

Income tax returns (Forms 1120, 1065, 1041, etc.)

-

Employment tax filings (Forms 941, 940, W-2s, W-3s)

-

Excise tax forms (Form 720 and others)

-

Information returns (1099s issued to vendors and contractors)

Using the correct EIN ensures that your filings are properly credited to your business, avoiding penalties and misapplied payments.

7. How to Protect and Manage Your EIN

Treat your EIN like confidential information — it can be used for fraud if exposed.

-

Keep EIN letters and IRS correspondence in a secure place.

-

Only share your EIN with trusted institutions (banks, accountants, licensing agencies).

8. Where to Get Help or Apply

-

Apply for an EIN Online (Free): www.einregister.online

-

International Applicants (No SSN/ITIN): Call +1-502-547-2551

Key Takeaways

| Rule | What It Means |

|---|---|

| Each business must have its own EIN | Never share between entities |

| Notify IRS of major changes | File Form 8822-B for updates |

| EINs are permanent | Do not reapply unless required |

| EIN is needed for hiring, taxes, and banking | Core identifier for all federal filings |

| Protect your EIN | Guard against fraud and misuse |

Final Thoughts

An EIN is more than a number — it’s your business’s federal identity. Following IRS rules ensures your tax filings, payroll, and compliance stay accurate and penalty-free. Whether you’re starting a new company or restructuring, understanding when and how to use your EIN keeps your business running smoothly and legally.