What Is the EIN Assignment Letter (CP 575)?

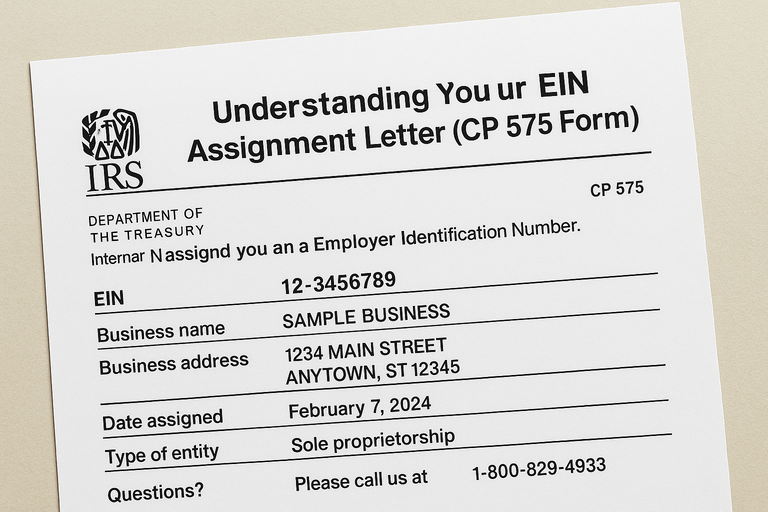

The CP 575 is an official letter issued by the Internal Revenue Service (IRS) to confirm that your business has been assigned an Employer Identification Number.

It serves as your primary proof of EIN registration and includes essential information such as your business name, EIN, and address. The IRS typically sends it by mail within 4–6 weeks after your EIN application is approved (or instantly via email if applied online).

What Information Is on the CP 575 Letter?

The EIN Assignment Letter includes several key details about your business registration:

-

Business Legal Name — The exact name under which your EIN is registered.

-

Business Address — The mailing address used on your EIN application.

-

EIN Number — A unique nine-digit identifier (formatted as XX-XXXXXXX).

-

IRS Contact Information — The IRS office that issued the EIN.

-

Date of Issuance — The date your EIN was officially assigned.

-

Important Tax Guidance — Instructions on how to use your EIN for tax reporting and compliance.

Tip: The CP 575 letter may look simple, but banks, lenders, and government agencies rely on it for identity verification — so keep it safe and never share it publicly.

Why the CP 575 Letter Is Important

Your CP 575 form acts as proof of business identity and is required in multiple scenarios, such as:

-

Opening a business bank account

-

Applying for business licenses or permits

-

Setting up payroll and reporting employee taxes

-

Registering with the state tax department

-

Applying for business loans or credit lines

-

Filing federal and state tax returns

Without this letter, your business may face delays or rejections in official processes.

What If You Lose Your CP 575 Letter?

If you’ve misplaced your original CP 575 letter, don’t panic — you can still get a replacement document called a 147C EIN Verification Letter.

Here’s how to request it:

-

Call the IRS Business & Specialty Tax Line:

1-800-829-4933 (available Monday–Friday, 7 AM to 7 PM local time). -

Provide verification details (such as business name, address, and EIN).

-

Request that the IRS mail or fax your 147C letter, which serves as an official EIN confirmation.

The IRS does not reissue CP 575 forms — the 147C letter replaces it for all official purposes.

How to Keep Your EIN Letter Safe

Since the CP 575 letter contains sensitive business information, follow these best practices:

-

Scan and store digital copies in secure, encrypted folders.

-

Keep the original document in a locked file or safe.

-

Never post or share your EIN publicly.

-

Provide copies only to verified financial institutions or government agencies.

Conclusion

Your EIN Assignment Letter (CP 575) is one of the most important documents your business will ever receive from the IRS. It’s your official proof of business identity and the foundation for tax, banking, and licensing operations.

If you ever lose it, request a 147C replacement letter immediately and always keep backups. Safeguarding your EIN documentation ensures your business stays compliant and ready for any official verification.