Online EIN / Tax ID Application

Apply quickly and securely for your Employer Identification Number with a simple, guided process.

Select your Application typeWhat is an EIN?

An Employer Identification Number (EIN), also known as a Federal Tax ID, is a unique identifier issued to businesses for tax and regulatory purposes. It is required for most organizations to open a bank account, hire employees, and file business taxes.

Why Apply Online?

Applying online is the fastest and most convenient way to receive your EIN. Our platform streamlines the process by guiding you step by step, reducing errors, and saving time compared to paper forms or manual filing.

Who Needs an EIN?

- Businesses such as corporations, LLCs, and partnerships

- Sole proprietors who hire employees or operate under a trade name

- Non-profit and religious organizations

- Trusts and estates handling financial or legal matters

- Any entity that must file federal taxes separately from an individual

How Our Service Works

- Complete the simple online application form with your business details.

- Review your information to ensure accuracy before submission.

- Submit securely and receive confirmation of your EIN assignment.

Latest News, Advice & Best Practices

Common EIN Application Mistakes to Avoid

Applying for an Employer Identification Number (EIN) is usually straightforward, but small errors can cause big delays, IRS rejections, or future tax problems. Whether you’re a new business owner, LLC, corporation, or foreign entity, avoiding these common EIN application mistakes will save time and frustration.

Feb. 5, 2026, 10:36 a.m.

Read more

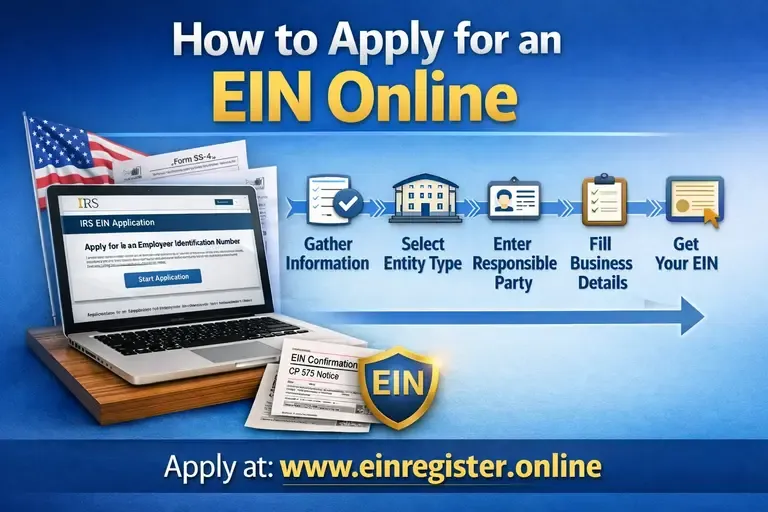

How to Apply for an EIN Online

How to apply for an EIN online in the United States through the www.einregister.online

Jan. 27, 2026, 9:06 p.m.

Read more

EIN for Opening a Merchant or Payment Processing Account

Opening a merchant account or payment processing account (Stripe, PayPal, Square, Authorize.net, etc.) in the U.S. almost always requires an EIN (Employer Identification Number)—especially if you’re operating as a business entity. Below is exactly why it’s required, when it’s optional, and how to get approved faster.

Jan. 25, 2026, 10:41 a.m.

Read more