-

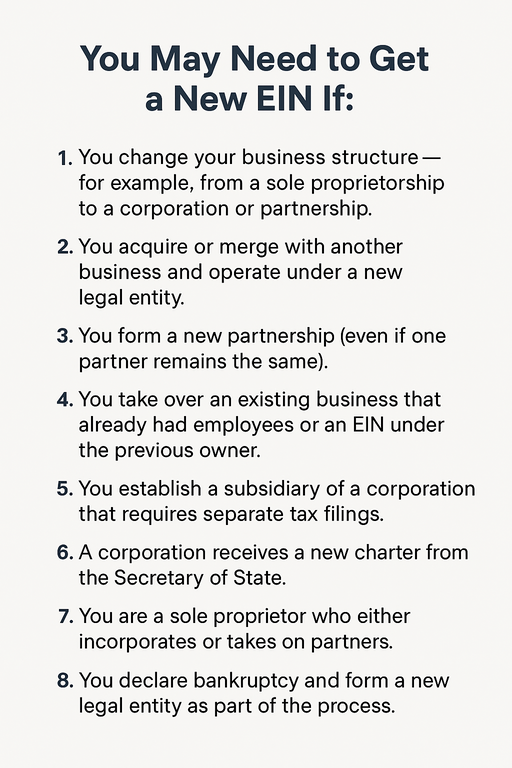

You change your business structure — for example, from a sole proprietorship to a corporation or partnership.

-

You acquire or merge with another business and operate under a new legal entity.

-

You form a new partnership (even if one partner remains the same).

-

You take over an existing business that already had employees or an EIN under the previous owner.

-

You establish a subsidiary of a corporation that requires separate tax filings.

-

A corporation receives a new charter from the Secretary of State.

-

You are a sole proprietor who either incorporates or takes on partners.

-

You declare bankruptcy and form a new legal entity as part of the process.

You may need to get a new EIN if:

Oct. 23, 2025, 6:41 p.m.

Good question — let’s go into detail on when you need to get a new EIN (Employer Identification Number) according to IRS rules.