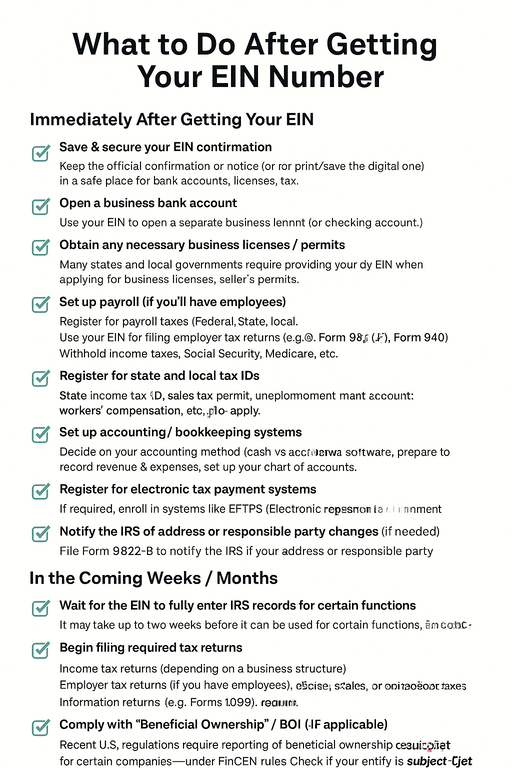

✅ Immediately After Getting Your EIN

-

Save & secure your EIN confirmation

Keep the official confirmation or notice (or print/save the digital one) in a safe place. You’ll need it for bank accounts, licenses, tax returns, etc. -

Open a business bank account

Use your EIN to open a separate business bank account (or checking account). Keeping finances separate is important for accounting and liability protection. -

Obtain any necessary business licenses / permits

Many states and local governments require you to provide your EIN when applying for business licenses, seller’s permits, health permits, etc. -

Set up payroll (if you’ll have employees)

-

Register for payroll taxes (Federal, state, local)

-

Use your EIN for filing employer tax returns (e.g. Form 941, Form 940)

-

Withhold income taxes, Social Security, Medicare, etc. from employees

-

-

Register for state and local tax IDs

Depending on your state, you may need a state income tax ID, sales tax permit, unemployment insurance account, workers’ compensation, etc. Many states require your federal EIN when applying. -

Set up accounting / bookkeeping systems

Decide on your accounting method (cash vs accrual), choose software, prepare to record revenue & expenses, set up your chart of accounts. -

Register for electronic tax payment systems

If required, enroll in systems like EFTPS (Electronic Federal Tax Payment System) to make federal tax payments. -

Notify the IRS of address or responsible party changes (if needed)

If your address or responsible party changes in the future, you’ll need to file Form 8822-B to notify the IRS.

In the Coming Weeks / Months

-

Wait for the EIN to fully enter IRS records for certain functions

Although you get the EIN immediately, it may take up to two weeks before it can be used for certain functions (e.g. electronic filing, TIN matching) per IRS guidance. -

Begin filing required tax returns

-

Income tax returns (depending on business structure)

-

Employer tax returns (if you have employees)

-

Excise, sales, or other applicable taxes

-

Information returns (e.g. Forms 1099)

-

-

Comply with “Beneficial Ownership” / BOI (if applicable)

Recent U.S. regulations may require reporting of beneficial ownership information for certain companies (under FinCEN rules) — check if your entity is subject. -

Maintain proper recordkeeping

Retain receipts, invoices, payroll records, contracts, etc. Good records will be essential for audits. -

Review whether you need a new EIN in the future

Most changes (like changing your business name or address) don’t require a new EIN. But major changes (e.g. changing entity type from sole proprietor to corporation, or partnership to LLC) may require a new EIN. -

Close or deactivate your EIN if you dissolve or cease business (if applicable)

If you end your business operations, make sure to file final returns and notify the IRS to close your accounts. Although EINs cannot be reused, the IRS can mark them inactive.