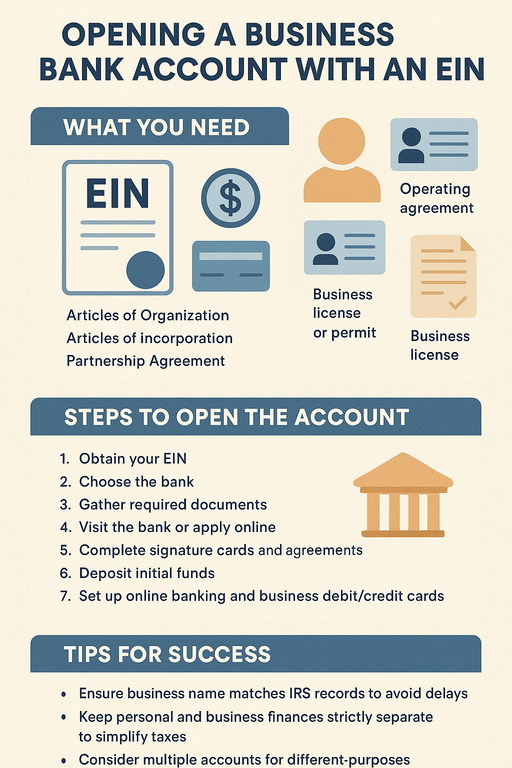

To open a business bank account using an EIN, most banks require:

-

EIN (Employer Identification Number): Issued by the IRS (Form SS-4).

-

Business formation documents:

-

LLC → Articles of Organization

-

Corporation → Articles of Incorporation

-

Partnership → Partnership Agreement

-

Sole Proprietorship → May just require a DBA (Doing Business As) certificate if operating under a trade name.

-

-

Personal identification: Government-issued ID (driver’s license or passport).

-

Operating Agreement or Bylaws (for LLCs and corporations).

-

Business license or permit (if applicable).

2. Why an EIN is Required

-

Banks use the EIN to identify your business for tax purposes.

-

The EIN separates your personal finances from business finances.

-

It’s required if your business has employees or is a partnership or corporation.

3. Steps to Open the Account

-

Obtain your EIN from the IRS (online application is fastest).

-

Choose the bank: Compare fees, online banking options, and account features.

-

Gather required documents (listed above).

-

Visit the bank or apply online: Many banks allow online business account setup.

-

Complete signature cards and agreements: The bank will verify authorized signers.

-

Deposit initial funds: Minimum deposit varies by bank.

-

Set up online banking and business debit/credit cards.

4. Tips for Success

-

Ensure your business name matches IRS records to avoid delays.

-

Keep personal and business finances strictly separate to simplify taxes.

-

Consider multiple accounts for different purposes (operations, taxes, payroll).

-

Ask about fees, transaction limits, and online banking tools.