What Is an EIN?

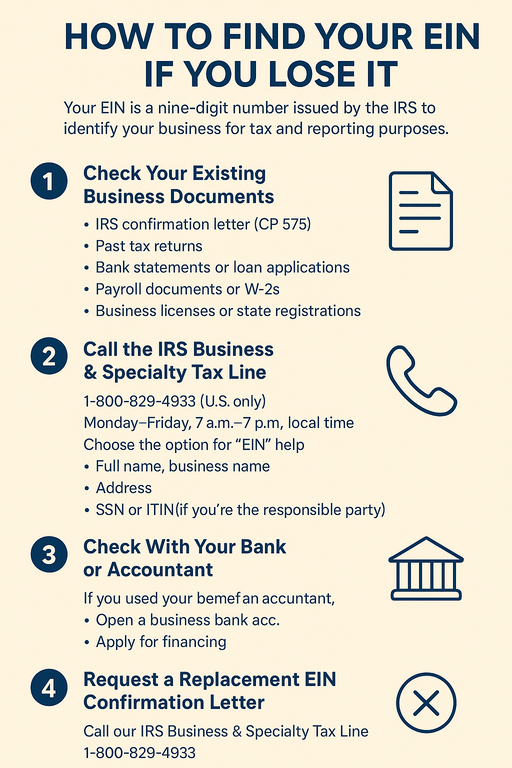

Your Employer Identification Number (EIN) — also called a Federal Tax ID Number — is a nine-digit number issued by the IRS to identify your business for tax and reporting purposes.

It’s essential for things like:

-

Filing taxes

-

Opening a business bank account

-

Applying for permits or loans

-

Hiring employees

If you misplace your EIN, don’t panic — there are several ways to recover it.

1. Check Your Existing Business Documents

Your EIN appears on many official papers, so check the following first:

-

IRS confirmation letter (CP 575) — sent when your EIN was first issued

-

Past tax returns — look at the top of your filed business tax returns (Form 1120, 1065, 941, etc.)

-

Bank statements or loan applications — EINs are often listed when opening accounts

-

Payroll documents or W-2s — if you have employees, your EIN appears there

-

Business licenses or state registrations — many include your EIN for tax ID purposes

2. Call the IRS Business & Specialty Tax Line

If you can’t locate your EIN on documents, contact the IRS directly:

IRS Business & Specialty Tax Line:

1-800-829-4933 (U.S. only)

Hours: Monday–Friday, 7 a.m.–7 p.m. local time

When you call:

-

Choose the option for “EIN” help

-

Be prepared to verify your identity:

-

Full name

-

Business name

-

Address

-

SSN or ITIN (if you’re the responsible party)

-

The IRS will provide your EIN over the phone once your identity is confirmed.

(They won’t email or fax it for security reasons.)

3. Check With Your Bank or Accountant

If you used your EIN to:

-

Open a business bank account,

-

Apply for financing, or

-

File taxes through an accountant —

Then your bank or tax preparer may have your EIN on file.

You can request it from them after verifying your identity.

4. Request a Replacement EIN Confirmation Letter

If you want a replacement of your original EIN notice (CP 575), you can request a verification letter (147C) from the IRS.

How to get it:

-

Call the IRS Business & Specialty Tax Line (same number: 1-800-829-4933)

-

Ask for an “EIN verification letter (147C)”

-

You can choose to have it mailed or faxed (IRS does not email these)

5. Don’t Reapply for a New EIN (Unless Required)

Many people mistakenly try to apply for a new EIN — this can cause tax confusion.

Only get a new EIN if:

-

You’re starting a new legal entity (e.g., forming a new LLC or corporation), or

-

Your business ownership structure changes significantly.

Otherwise, always recover and continue using your original EIN.

Quick Recap

| Step | What to Do | Best For |

|---|---|---|

| 1 | Check your IRS letters, tax returns, bank records | Fastest recovery |

| 2 | Call IRS Business & Specialty Line (1-800-829-4933) | Direct official lookup |

| 3 | Ask your bank or accountant | If they filed paperwork for you |

| 4 | Request a 147C confirmation letter | To replace lost IRS letter |

| 5 | Avoid reapplying | Prevent duplicate EINs |