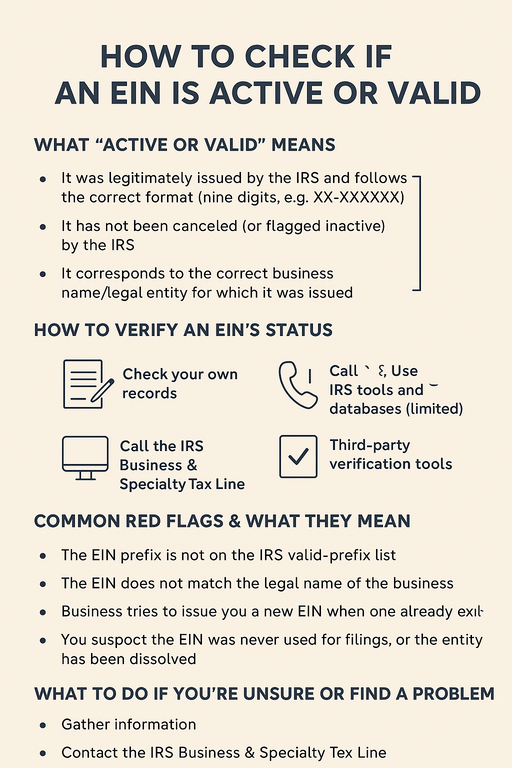

What “Active or Valid” Means

For an EIN:

-

It was legitimately issued by the Internal Revenue Service (IRS) and follows the correct format (nine digits, e.g. XX-XXXXXXX).

-

It has not been canceled (or flagged inactive) by the IRS. According to IRS guidance, “we cannot cancel an EIN, but we can deactivate it.”

-

It corresponds to the correct business name/legal entity for which it was issued (for purposes of tax filings, licensing, contracts).

How to Verify an EIN’s Status

Here are the best methods available:

1. Check Your Own Records

-

Locate the original IRS confirmation letter (e.g., CP 575), which shows the assigned EIN.

-

Review prior tax returns, bank account applications, state business registrations — these often list the EIN.

-

Contact your bank or accountant who handled your business filings; they may have the EIN on file.

2. Call the IRS Business & Specialty Tax Line

-

Phone number: 800-829-4933 (Monday–Friday, 7 a.m.–7 p.m. ET)

-

When you call, the IRS can verify the EIN for you if you are an authorized person for the entity.

-

The IRS will not provide full public look-up of any random EIN; they’ll only assist for your own business.

3. Use IRS Tools & Databases (Limited)

-

The IRS publishes a list of “valid EIN prefixes” (first two digits) by campus/location of issuance, which can help identify obviously invalid numbers.

-

For nonprofit organizations, the IRS’s Tax Exempt Organization Search lets you verify EINs publicly for registered charities.

-

For other businesses (especially private ones) there is no free public comprehensive lookup from the IRS for “EIN active/inactive” status.

4. Third-Party Verification Tools

-

Several services (e.g., vendor onboarding, “Know Your Business” platforms) offer EIN verification or matching utilities. They typically cross-reference IRS/TIN-matching services, state databases, or commercial sources.

-

Note: These may incur fees and rely on external sources — use caution and verify data accuracy.

Common Red Flags & What They Mean

-

The EIN prefix (first two digits) is not on the IRS valid-prefix list. While not definitive, this suggests a potential invalid number.

-

The EIN number does not match the legal name of the business entity when doing vendor onboarding or filings (name + EIN mismatch).

-

Business attempts to issue you a new EIN when one already exists for the entity — might indicate confusion or improper entity structure.

-

You suspect the EIN was never used for filings, or the entity has been dissolved — it’s possible the EIN remains “assigned” but the business is inactive/closed. In such cases the EIN may still technically be valid but not “active” in the sense of current operations.

What to Do If You’re Unsure or Find a Problem

-

Gather information: legal business name, address, previous tax filings, any correspondence from IRS.

-

Contact the IRS Business & Specialty Tax Line (800-829-4933) and ask if the EIN is on record and matches your entity.

-

If your business underwent a change that should have required a new EIN (change in entity type, ownership structure) check whether the correct EIN is being used.

-

If you discover an EIN is invalid or misused, consult a tax professional, especially if you’re engaged in business contracts relying on another party’s EIN.

-

Maintain documentation: once you verify the EIN status, keep the confirmation letter, correspondence, vendor contracts, etc., so you can prove validity if needed.