Key Facts at a Glance

-

A non-U.S. citizen or non-resident can obtain a U.S. EIN even if they do not have an SSN or ITIN.

-

The online EIN application system provided by the Internal Revenue Service (IRS) requires an SSN or ITIN, so foreign applicants must use alternative submission methods (fax, mail, sometimes phone).

-

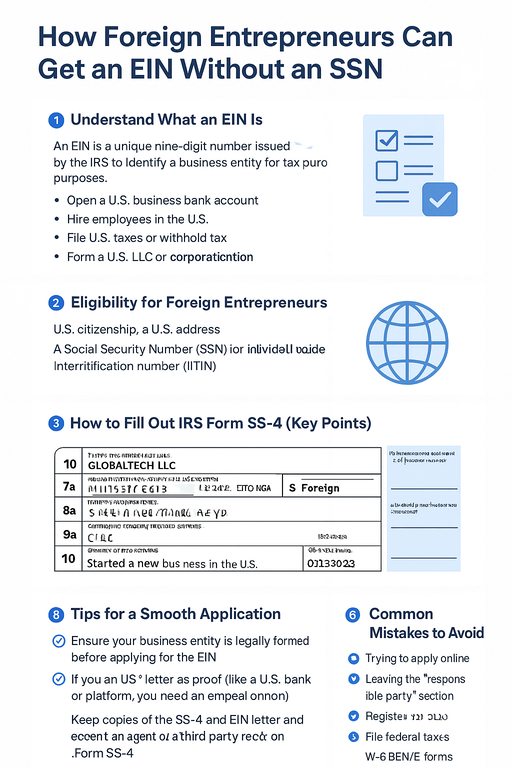

The form you’ll use is Form SS‑4 (Application for Employer Identification Number).

Step-by-Step Process for Foreign Entrepreneurs

1. Form Your U.S. Business Entity (if not already done)

Before applying for the EIN, you typically need you to have formed the U.S. business entity (for example an LLC or corporation). This entity must have the required formation documents in the state of incorporation.

2. Download & Fill Out Form SS-4

-

Download Form SS-4 from the IRS website.

-

Key fields you’ll pay attention to:

-

Line 7b (SSN/ITIN of responsible party): If you have no SSN/ITIN, you’ll leave this blank or write "N/A" or “Foreign”.

-

Line 10 (“Reason for applying”): If the application is for a foreign owner applying for U.S. business, you may check “Other” and write something like “Foreign person – no SSN/ITIN”.

-

-

Ensure all other required information (entity name, address, type of business, responsible party contact details) is accurate and matches your formation documents. Errors are common reasons for rejection.

3. Choose Submission Method

Since you lack an SSN/ITIN and can’t use the online portal, you choose one of the alternative methods:

-

Fax: This is often the fastest. For foreign applicants a fax number such as +1-304-707-9471 is mentioned.

-

Mail: Slower, but standard. Mail the completed Form SS-4 to:

-

Phone: In certain cases, foreign applicants may call the IRS international EIN line.

4. Wait for the EIN Assignment

-

If submitted by fax and all is in order, you may receive the EIN fairly quickly (e.g., within a few business days) via fax.

-

If by mail, expect longer — often 4–6 weeks or more.

-

The official document issued by the IRS confirming your EIN is the “Letter CP 575”. You’ll use this to open U.S. bank accounts, register payment processors, etc.

5. Use & Maintain Your EIN

-

Once issued, use the EIN for your U.S. business banking, tax filings, employer withholdings (if any), and general business identity.

-

Note: If your business later requires a U.S. tax return, you’ll use the same EIN — do not apply for a new one simply because you later get an SSN/ITIN

-

Make sure the responsible party information is kept current (if there are changes, you may need to update the IRS).

Important Considerations & Pitfalls

-

Online application will not work for you since you lack an SSN/ITIN. Attempting to proceed online will cause errors.

-

Responsible Party Definition: The person listed as the “responsible party” on the SS-4 form must be an individual who controls or manages the business. This can be a foreign individual. Be certain you understand who should be listed.

-

Mailing address: Although you can be abroad, it is often beneficial to have a U.S. mailing address or registered agent address to receive official correspondence. Some applications mention using a U.S. address.

-

Accuracy matters: Mistakes in names, entity type, or leaving ambiguous terms can cause delays or rejection. Many guides warn about common errors.

-

No SSN/ITIN doesn’t exempt you from tax obligations: Even though getting an EIN is possible without them, if you are required to file U.S. tax returns (because of U.S. trade or business) you may need an ITIN or other taxpayer identification in due course.

-

Be wary of “too good to be true” services: Some services claim instant EIN issuance for foreign applicants; always ensure compliance.

Summary

Yes — as a foreign entrepreneur without an SSN (and possibly without an ITIN), you can obtain a U.S. EIN for your U.S. business entity. You’ll need to fill out Form SS-4, submit it via fax or mail (or sometimes phone), and clearly indicate the responsible party does not have an SSN/ITIN (e.g., write “Foreign” or “N/A”). Once approved, you’ll receive an official EIN from the IRS. The key is accuracy, patience, and proper preparation.