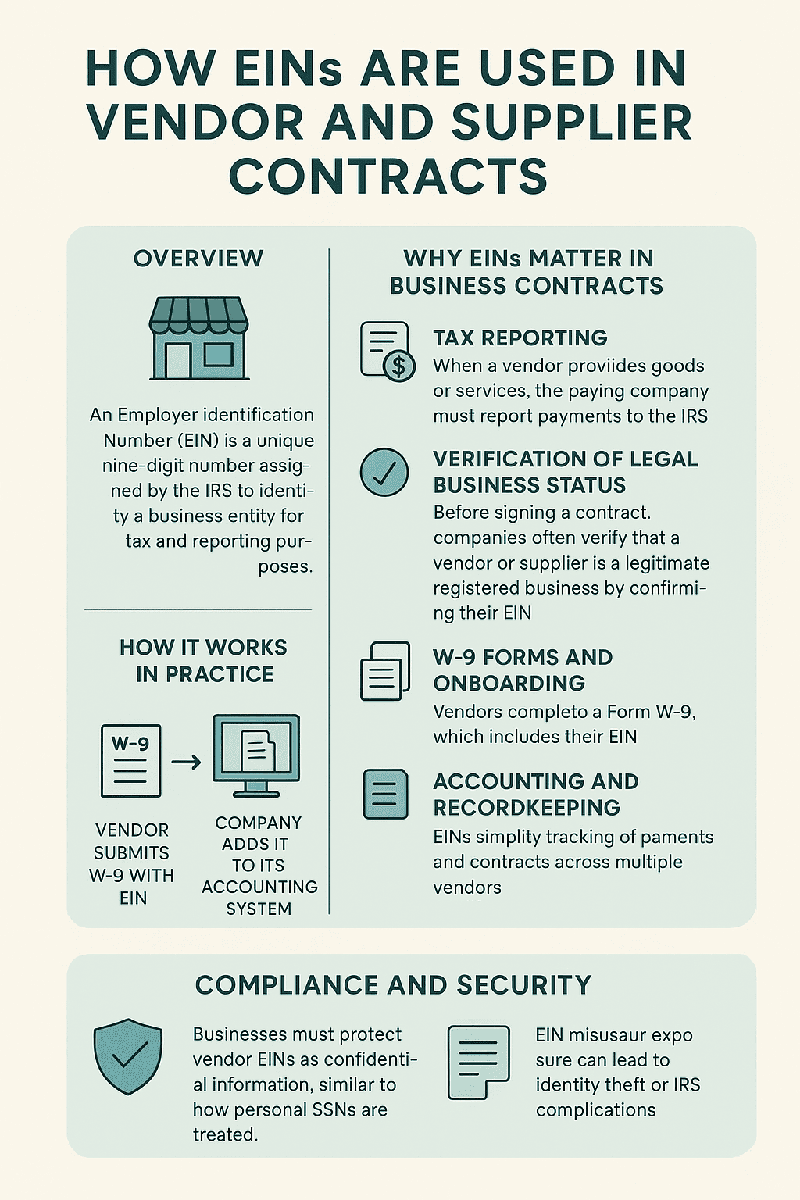

Why EINs Matter in Business Contracts

-

Tax Reporting

-

When a vendor provides goods or services, the paying company must report payments to the IRS.

-

The vendor’s EIN is used on Form 1099-NEC (for independent contractors) or Form 1099-MISC (for other payments).

-

-

Verification of Legal Business Status

-

Before signing a contract, companies often verify that a vendor or supplier is a legitimate registered business by confirming their EIN.

-

This prevents fraud and ensures compliance with U.S. tax laws.

-

-

W-9 Forms and Onboarding

-

Vendors complete a Form W-9, which includes their EIN.

-

The form is used by the hiring company to prepare tax documents and verify vendor identity.

-

-

Accounting and Recordkeeping

-

EINs simplify tracking of payments and contracts across multiple vendors.

-

They help maintain accurate records for audits and tax filings.

-

How It Works in Practice

-

Vendor submits W-9 with EIN → Company adds it to its accounting system.

-

Contracts reference the vendor’s EIN as part of the tax identity clause.

-

At year-end, the company issues 1099 forms reporting total payments under that EIN.

Compliance and Security

-

Businesses must protect vendor EINs as confidential information, similar to how personal SSNs are treated.

-

EIN misuse or exposure can lead to identity theft or IRS complications.

-

Companies are advised to store EIN data securely and limit access to authorized personnel only.

Key Takeaway

An EIN ensures transparency, accountability, and tax compliance in vendor and supplier relationships. It’s an essential identifier for every contract, confirming that payments, taxes, and records are properly aligned across both parties.