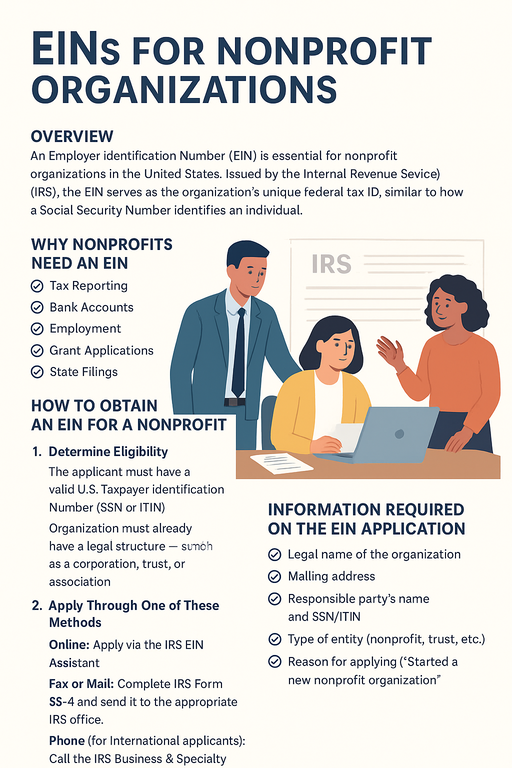

Why Nonprofits Need an EIN

Nonprofit organizations must have an EIN for several key reasons:

-

Tax Reporting: The EIN is used to file IRS Form 990 or Form 990-EZ for annual reporting.

-

Bank Accounts: Banks require an EIN to open a business or organizational account.

-

Employment: Hiring staff or paying contractors requires an EIN for payroll tax reporting.

-

Grant Applications: Most federal, state, and private grantors require an EIN to verify legitimacy.

-

State Filings: States often require EINs for charity registrations and state tax exemptions.

How to Obtain an EIN for a Nonprofit

The process is free and relatively quick.

Step 1: Determine Eligibility

-

The applicant must have a valid U.S. Taxpayer Identification Number (SSN or ITIN).

-

The organization must already have a legal structure — such as a corporation, trust, or association.

Step 2: Apply Through One of These Methods

-

Online: Apply via the IRS EIN Assistant.

-

Fax or Mail: Complete IRS Form SS-4 and send it to the appropriate IRS office.

-

Phone (for international applicants): Call the IRS Business & Specialty Tax Line at +1-267-941-1099.

Step 3: Receive Your EIN

-

Online applicants get an EIN immediately.

-

Fax or mail applications take 1–4 weeks for processing.

Information Required on the EIN Application

-

Legal name of the organization

-

Mailing address

-

Responsible party’s name and SSN/ITIN

-

Type of entity (nonprofit, trust, etc.)

-

Reason for applying (“Started a new nonprofit organization”)

After Receiving the EIN

Once your organization has an EIN, you can:

-

Apply for IRS 501(c)(3) or other tax-exempt status.

-

Register for state charitable solicitations.

-

Set up donation and payroll systems.

-

File annual reports and maintain compliance.

Common Mistakes to Avoid

-

Applying for an EIN before forming the nonprofit entity with your state.

-

Using an individual’s personal SSN for organizational activities.

-

Failing to report changes in address or leadership to the IRS.

Conclusion

An EIN is the first formal step in launching a legitimate and compliant nonprofit organization in the U.S. It not only identifies your organization to the IRS but also enables you to build financial credibility, apply for grants, and begin operations legally.