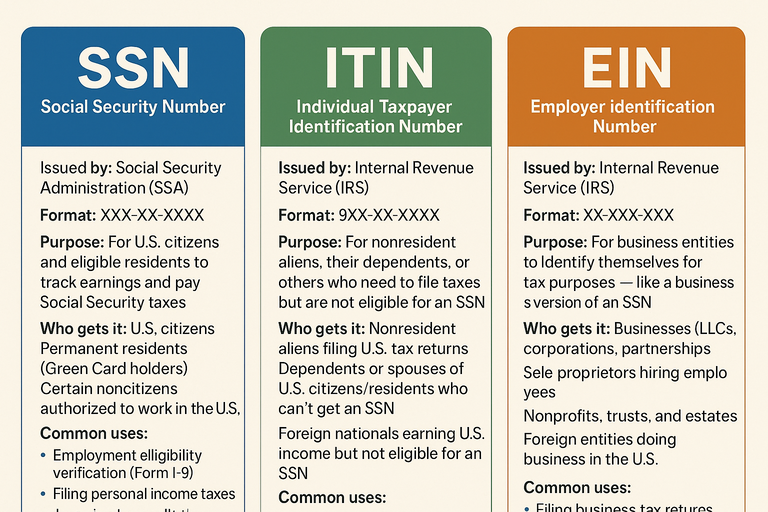

Social Security Number (SSN)

What it is:

-

The SSN is a nine-digit number issued by the Social Security Administration (SSA) to U.S. citizens, permanent residents, and certain work-authorized non-citizens.

-

Format is typically

XXX-XX-XXXX.

Primary uses:

-

Work authorization and reporting wages.

-

Filing individual income tax returns (personal tax ID).

-

Access to Social Security benefits (for eligible individuals).

-

Opening many bank accounts, applying for loans, registering for certain government services.

When you need it:

-

If you live in the U.S. and are eligible to work (citizen or authorized).

-

If you are going to be paid wages by an employer.

-

Generally, you should not get an ITIN if you’re eligible for an SSN.

Key limitation:

-

If you were eligible for an SSN, you can’t keep an ITIN; you’d switch to your SSN and notify the IRS.

Individual Taxpayer Identification Number (ITIN)

What it is:

-

The ITIN is a nine-digit number issued by the Internal Revenue Service (IRS) to individuals who cannot obtain an SSN but still have U.S. tax-filing obligations.

-

Format: begins with a “9”, e.g.,

9XX-XX-XXXX.

Primary uses:

-

For individuals (resident or nonresident aliens) who need to file U.S. tax returns or claim treaty benefits but are not eligible for an SSN.

-

It does not authorize work in the U.S., nor does it provide Social Security benefits.

When you need it:

-

If you’re a non-resident alien or resident alien for tax purposes, you don’t have/work authorization for an SSN, but you must file a U.S. tax return or get a U.S. tax ID.

Key limitation:

-

Cannot be used instead of an SSN if you actually are eligible for an SSN.

-

Does not grant eligibility for many tax credits (for example, the Earned Income Tax Credit).

Employer Identification Number (EIN)

What it is:

-

The EIN is a nine-digit number issued by the IRS as a federal tax identification number for businesses, trusts, estates, and other entities.

-

Format: often

XX-XXXXXXX.

Primary uses:

-

Identifying a business entity for tax filings, payroll, opening business bank accounts.

-

Required if your business has employees, operates as a corporation or partnership, files certain tax returns, or withholds taxes for non-resident aliens.

When you need it:

-

If you have a business entity distinct from a sole proprietor using their SSN, or you hire employees.

-

Many businesses obtain one even if not strictly required, to separate personal and business finances.

Key limitation:

-

Cannot be used in place of an SSN or ITIN for an individual’s personal tax filing. Entities and individuals are separate.

Quick Comparison Table

| ID Type | Issuing Agency | Format | Issued To | Primary Use |

|---|---|---|---|---|

| SSN | SSA | XXX-XX-XXXX |

U.S. citizens + authorized workers | Personal identification for work & tax |

| ITIN | IRS | 9XX-XX-XXXX |

Individuals not eligible for SSN but must file taxes | Tax filing only (no work authorization) |

| EIN | IRS | XX-XXXXXXX |

Businesses, trusts, estates, etc. | Business tax ID, payroll, business banking |

Why It Matters

-

Using the wrong ID on tax forms or for payroll can create compliance issues or delays.

-

Keeping personal and business finances separate (e.g., using EIN for business rather than SSN) helps with privacy, accounting, and liability.

-

Non-residents, foreign nationals, and business owners must be especially careful to choose the correct ID, apply properly, and maintain compliance.