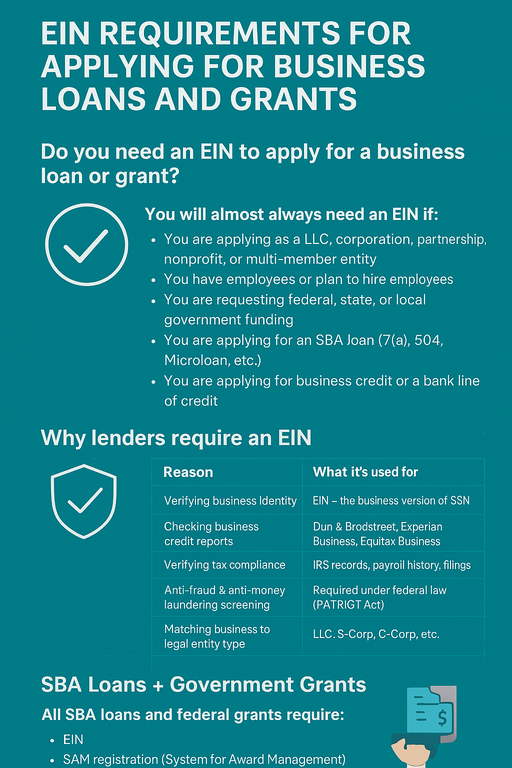

Do you need an EIN to apply for a business loan or grant?

In most cases, yes — lenders and grant agencies require an EIN because it acts as the official tax ID for the business, similar to how a Social Security Number (SSN) identifies an individual.

You will almost always need an EIN if:

-

You are applying as a LLC, corporation, partnership, nonprofit, or multi-member entity

-

You have employees or plan to hire employees

-

You are requesting federal, state, or local government funding

-

You are applying for an SBA loan (7(a), 504, Microloan, etc.)

-

You are applying for business credit or a bank line of credit

You may be able to apply without an EIN if:

-

You are a sole proprietor with no employees

-

The lender accepts SSN-only identification (some micro-lenders, PayPal Working Capital, Kabbage, Square Capital, etc.)

-

You are applying for personal financing used for business (not recommended for liability reasons)

But even sole proprietors who can technically apply without an EIN are strongly encouraged to get one, because lenders treat EIN-registered businesses as more legitimate and lower-risk.

Why lenders require an EIN

| Reason | What it’s used for |

|---|---|

| Verifying business identity | EIN = the business version of an SSN |

| Checking business credit reports | Dun & Bradstreet, Experian Business, Equifax Business |

| Verifying tax compliance | IRS records, payroll history, filings |

| Anti-fraud & anti-money laundering screening | Required under federal law (PATRIOT Act) |

| Matching business to legal entity type | LLC, S-Corp, C-Corp, etc. |

Banks cannot legally issue most forms of business credit without a tax ID.

SBA Loans + Government Grants

All SBA loans require an EIN, including:

-

SBA 7(a)

-

SBA 504

-

SBA Microloan Program

-

SBA Disaster Loans (EIDL, Hurricane Relief, etc.)

All federal grants (via Grants.gov, USDA, DOE, DOD, etc.) require:

EIN

SAM registration (System for Award Management)

UEI (Unique Entity Identifier – replaces DUNS)

So, without an EIN, you cannot get federal funding.

Banks & Business Credit Lines

Most banks require an EIN for:

-

Business checking account

-

Business credit card

-

Business line of credit

-

Term loans

-

Equipment financing

-

Commercial real estate loans

Examples of banks requiring EIN:

-

Chase

-

Bank of America

-

Wells Fargo

-

US Bank

-

Truist

-

PNC

Even credit unions require an EIN for multi-member or employer-based entities.

Fintech & Online Lenders

Some lenders allow SSN-only applications, but will request an EIN later if the business is not sole-proprietor only.

| Lender / Platform | EIN required? |

|---|---|

| PayPal Working Capital | SSN OK for sole props, EIN needed for LLC/Corp |

| Kabbage / American Express | EIN required unless sole prop |

| Shopify Capital | SSN OK unless business tax returns required |

| BlueVine | EIN required |

| Fundbox | EIN preferred |

| Amazon Lending | EIN required for business sellers |

Grants for Small / Minority / Women-Owned Businesses

Most state and private grant programs require EIN because they are issued to a business entity, not a person.

Examples:

| Program | EIN required? |

|---|---|

| State Small Business Credit Initiative (SSBCI) | Required |

| Community Navigator Grants | Required |

| MBDA Minority Business Grants | Required |

| Amber Grant (women founders) | Required after approval |

| FedEx Small Business Grant | Required to finalize award |

What happens if you apply without an EIN?

-

Your application may be rejected automatically

-

You may be classed as a personal borrower, not a business

-

You may not be eligible for tax-deductible interest or business tax filings

-

You cannot build business credit profiles (DUNS, Experian Biz, etc.)

-

You lose liability protection if you are an LLC but apply under SSN

How to get an EIN (free)

You can apply directly through the IRS (no fee):

Online — fastest (same-day)- www.einregister.online

Phone — (502) 547-2551

Summary

| Business Type | EIN Required for Loans/Grants? |

|---|---|

| Sole Proprietor, no employees | Sometimes optional |

| Sole Proprietor with employees | Required |

| LLC (single or multi-member) | Required |

| Corporation (C-Corp, S-Corp) | Required |

| Non-profit / 501(c)(3) | Required |

| Partnership | Required |

| Foreign-owned U.S. company | Required |