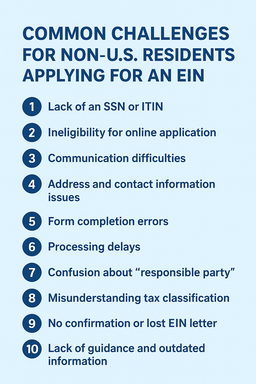

1. No Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

-

Problem: The IRS EIN application form (Form SS-4) asks for a “responsible party” with an SSN, ITIN, or existing EIN.

-

Why it matters: Non-U.S. residents often don’t have any of these.

-

Solution:

-

You can leave that field blank and note “Foreign” on Form SS-4.

-

You must apply by phone or fax/mail (not the online application), since the online system requires an SSN or ITIN.

-

2. Limited Access to the Online Application System

-

Problem: The IRS online EIN application is available only to applicants with a U.S. taxpayer ID and a U.S. address.

-

Solution:

-

Foreign entities must apply by fax or mail to the IRS (or sometimes by phone).

-

Processing time can be 2–4 weeks by fax, and 4–6 weeks by mail.

-

3. Difficulty Contacting the IRS

-

Problem:

-

International phone calls to the IRS Business & Specialty Tax Line can be costly and time-zone-challenging.

-

Wait times can be long, and some agents may not be familiar with foreign entity structures.

-

-

Solution:

-

Use the dedicated international number: +1-267-941-1099 (not toll-free).

-

Call during U.S. business hours (Mon–Fri, 6 a.m.–11 p.m. Eastern Time).

-

4. Unclear U.S. Business Structure

-

Problem: Many non-U.S. applicants aren’t sure how to classify their U.S. business for IRS purposes — LLC, corporation, or foreign entity.

-

Solution:

-

Consult a U.S. tax advisor before applying.

-

The EIN form (SS-4) requires the entity type and reason for applying — these choices affect future tax filings.

-

5. Mailing Address & Delivery Issues

-

Problem:

-

The IRS requires a mailing address for correspondence. Foreign addresses are accepted, but IRS mail delivery can be slow or inconsistent abroad.

-

-

Solution:

-

Consider using a U.S. mailing address (e.g., registered agent or virtual office) to receive IRS notices reliably.

-

6. Confusion About Documentation

-

Problem: The IRS doesn’t require incorporation documents for EIN issuance, but many applicants assume they need to attach them.

-

Solution:

-

Usually, only the Form SS-4 is required.

-

However, be prepared to provide supporting documents (like your certificate of formation) if the IRS requests verification.

-

7. Delays or Lost EIN Confirmation Letters

-

Problem: It’s common for foreign applicants not to receive their CP 575 confirmation letter by mail.

-

Solution:

-

You can call the IRS to request a replacement letter (Form 147C).

-

Always keep fax confirmation pages or any correspondence showing your EIN approval.

-

8. Misunderstanding Tax Obligations

-

Problem: Some foreign entities believe that obtaining an EIN automatically creates a U.S. tax filing requirement — which isn’t always true.

-

Solution:

-

An EIN by itself doesn’t trigger taxation.

-

Filing obligations depend on your U.S. activities, ownership, and structure.

-

Always confirm with a U.S. tax professional.

-

9. Processing Time and Bureaucracy

-

Problem: Manual review for foreign applications makes processing slower.

-

Solution:

-

Fax is faster than mail.

-

Include a return fax number on your SS-4 form to get your EIN faster (usually within 1–2 weeks).

-

10. Confusion Between EIN and ITIN

-

Problem: Non-U.S. individuals sometimes think they need an EIN when they actually need an ITIN (for personal tax filing).

-

Solution:

-

EIN → for businesses, trusts, or entities.

-

ITIN → for individuals filing U.S. taxes but not eligible for an SSN.

-