What Is an EIN?

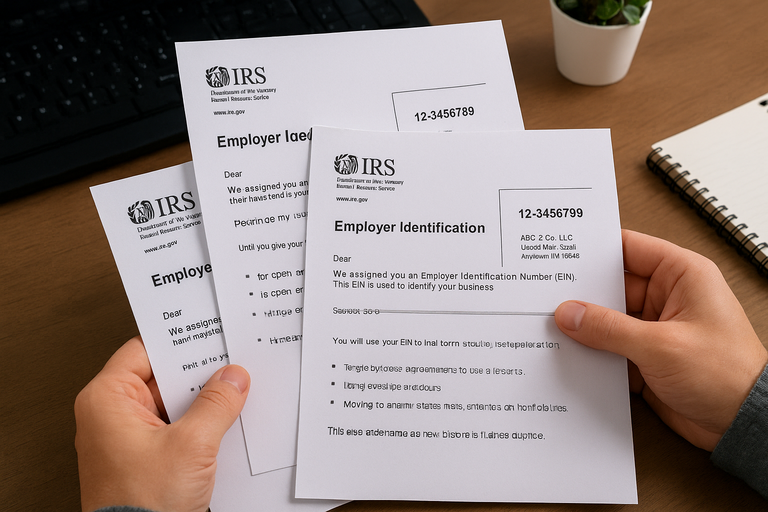

An Employer Identification Number (EIN) is a unique nine-digit number issued by the IRS to identify your business for tax and reporting purposes.

It’s like a Social Security number — but for your company.

You’ll use your EIN for:

-

Filing federal and state taxes

-

Opening business bank accounts

-

Hiring employees and managing payroll

-

Applying for business licenses and permits

When You Can Have More Than One EIN

The IRS allows multiple EINs only if each number is tied to a separate and distinct business entity.

For example:

-

You own two separate LLCs — each LLC needs its own EIN.

-

You operate a corporation and also manage a sole proprietorship — both require separate EINs.

-

You manage multiple trusts, estates, or nonprofits — each must have its own EIN.

In short, every legal entity must have its own EIN.

When You Cannot Have More Than One EIN

You cannot get multiple EINs for the same business.

For example:

-

One LLC cannot have two EINs.

-

Changing your business name does not require a new EIN.

-

Moving to another state does not automatically mean you need a new EIN.

If you apply for a new EIN for an existing business without legal changes, the IRS may reject your application or flag it as a duplicate.

When You Might Need a New EIN

You must apply for a new EIN if:

-

You change your business structure (e.g., sole proprietorship to LLC or corporation).

-

A corporation merges, reorganizes, or goes bankrupt.

-

There’s a transfer of ownership where a new entity is created.

How to Manage Multiple EINs

If you legitimately have multiple businesses and EINs:

-

Keep a record of each EIN and entity it belongs to.

-

Use the correct EIN for each tax filing and bank account.

-

Avoid mixing business finances between entities.

Misusing or confusing EINs can lead to IRS complications or delayed filings.

Final Thoughts

You can have more than one EIN, but only if each EIN belongs to a separate business or entity.

If your business structure remains the same, you only need one EIN — using multiple numbers for the same company can cause tax and legal issues.

When in doubt, always verify with the IRS or a tax professional (502) 547-2551 before applying for another EIN.